Ysios Capital, a leading Spanish biotechnology venture capital firm, today announced that its portfolio company CVRx Inc. has priced its initial public offering (IPO) and is trading on the Nasdaq Global Market (NASDAQ: CVRX). This is the second Ysios Capital portfolio company, alongside LAVA Therapeutics (NASDAQ:LVTX), to list on NASDAQ in the last 3 months.

CVRx Inc announced the pricing of its initial public offering of 7,000,000 shares of its common stock at a public offering price of $18.00 per share. In connection with the offering, CVRx has granted the underwriters a 30-day option to purchase up to an additional 1,050,000 shares of common stock at the initial public offering price, less the underwriting discount.

The shares began trading on the Nasdaq Global Select Market on June 30, 2021, under the ticker symbol “CVRX.” The gross proceeds from the offering, before deducting the underwriting discount and other offering expenses payable by CVRx, are expected to be approximately $126.0 million, excluding any exercise of the underwriters’ option to purchase additional shares.

Joël Jean-Mairet, Managing Partner at Ysios Capital comments “This Nasdaq IPO demonstrates the potential of both our portfolio and CVRx’s novel approach to heart failure treatment. “

J.P. Morgan, Piper Sandler and William Blair acted as joint book-running managers and as representatives of the underwriters for the offering. Canaccord Genuity acted as a lead manager for the offering.

About CVRx, Inc.

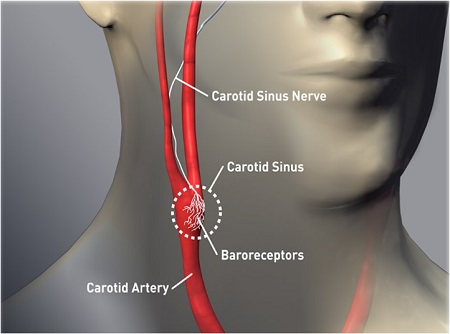

Headquartered in Minneapolis, MN, CVRx is a leader in innovative medical technologies that address the unmet needs in cardiovascular diseases with safe and effective therapies that harness and harmonize the body’s natural systems. CVRx is dedicated to improving patient outcomes, quality of life, and overall cardiovascular health via novel baroreceptor neuromodulation therapies.

About Ysios Capital

Ysios Capital is a leading Spanish venture capital firm that provides private equity financing to early- and midstage, highly innovative life science companies that develop disruptive therapeutic products and platform technologies to address clear medical needs. Ysios Capital was founded in 2008 and has €400 million in assets under management through its three funds, with a team of 15 investment professionals, 5 venture partners, 2 operational partners and offices in San Sebastián and Barcelona. For more information, please visit www.ysioscapital.com

cloud technology axon

Caldic has announced the acquisition of Ricardo Molina, a leading dist...

Capital-Riesgo.es

Subscribe to our newsletter and stay up to date with the latest news and deals!

2013 © Capital-Riesgo.es - Site Developments SL. All Rights Reserved. Terms of Service | Privacy Policy

Articles

Directory