The insurance landscape is on the brink of a transformational shift, driven by the convergence of data and artificial intelligence (AI). In a world where information is at the core of accurate pricing, and a business where innovation reigns supreme, leaders must embrace technological advancements to thrive in the digital era. In this Viewpoint, we embark on a journey through the promising future of insurance, exploring how AI technology revolutionizes the use of data in every aspect of this age-old sector.

Insurance companies have relied on data for centuries to make informed decisions and provide tailored coverage to their customers. It is the backbone of the industry, serving as the force behind critical functions that drive the sector’s success. Insurers use two main categories of data — structured and unstructured:

Unstructured data expands insurers’ understanding of customer behavior and thus needs by using data such as website visits and purchasing patterns. Until recently, access to this data type was costly and, in many instances, close to impossible. However, recent advancements in AI have made it possible to process, categorize, and analyze unstructured data quickly and efficiently.

Insurers also tap into disconnected external data sources such as social media, weather data, property-valuation data, credit scores, and government data to augment their internal data, which amplifies customer understanding and risk assessment and enables targeted product offerings and marketing campaigns.

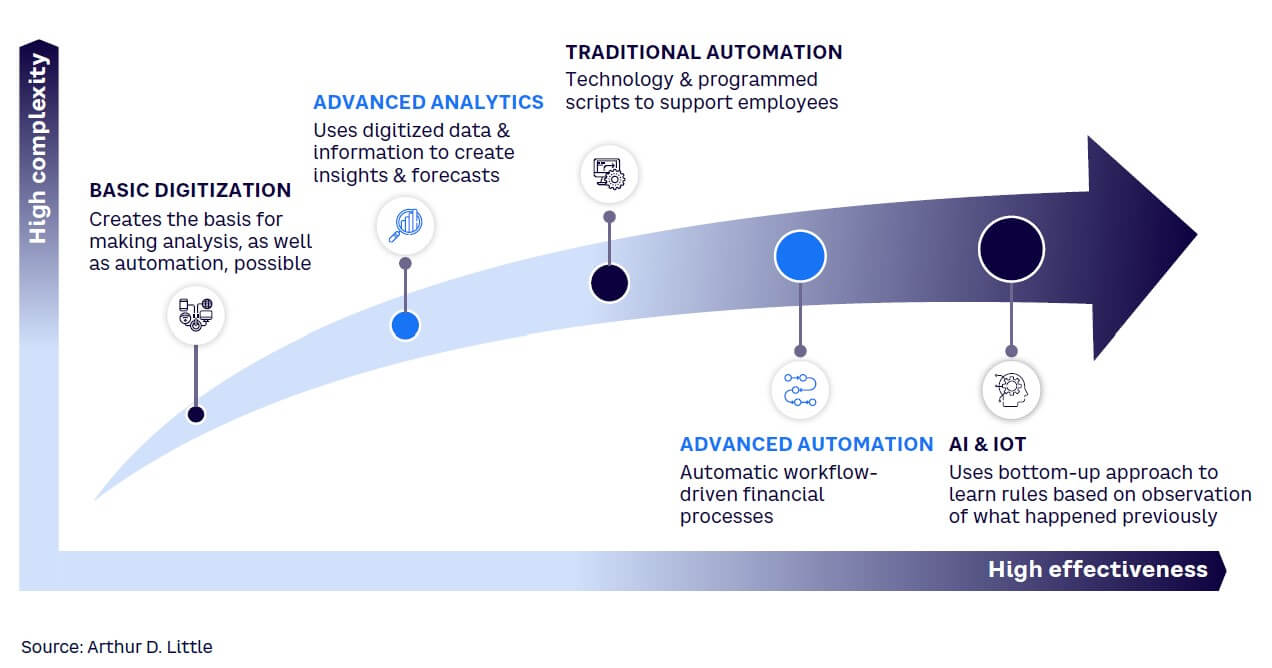

The rapid advancements in AI technologies are reshaping the future of the insurance industry (see Figure 1). AI encompasses a suite of tools, including but not limited to machine learning (ML), natural language processing (NLP), and image recognition (IR), which supports insurers’ capabilities and revolutionizes their operations:

AI is transforming insurance by boosting efficiency through advanced analytics and predictive modeling. For example, AI facilitates proactive fraud detection, individualized service, and more precise underwriting — all of which positively impact both pricing and claims cost.

The future of insurance hinges on integrating data and AI technologies effectively. With strategic implementation, insurers can optimize their operations, elevate customer experiences, and stay at the forefront of the dynamic insurance landscape. To maintain a competitive edge, insurance companies must prioritize robust data governance and ethical AI practices to ensure responsible use and build trust while meeting regulatory requirements.

To successfully integrate and deploy these AI applications, insurance companies should follow four steps (see Figure 2):

Once implemented, AI has the potential to positively influence the typical insurance customer journey while significantly increasing the quality of insurers. At the initial stage of an interaction, AI-powered chatbots and virtual assistants give immediate and specific support, addressing inquiries and guiding customers through the insurance-selection process. These intelligent systems can understand natural language, examine data, and offer relevant recommendations. By streamlining the information-gathering phase, AI elevates customer satisfaction and reduces friction, ultimately leading to a smoother experience. This will be especially powerful when brought to bear within an embedded setting, where insurance is sold as part of another product or service.

During the policy underwriting stage, AI algorithms can analyze vast amounts of data to assess risk profiles and calculate premiums with higher accuracy. By leveraging ML techniques, insurers can streamline the underwriting process while accessing more data, automating routine tasks, and ultimately making more accurate risk assessments. This not only saves time and resources, but also improves the insurers’ efficiency and effectiveness. When trained properly and without specific biases, AI-driven underwriting ensures that risk profiles remain impartial. This results in fair and unbiased pricing for policyholders, maximizing the overall customer experience and enabling insurers to provide more competitive pricing, tailored coverage options, and faster policy approvals.

In the event of a claim, AI can expedite the claims-processing and settlement process. By automating the claims assessment, AI algorithms can analyze claim data, assess damages, and determine coverage eligibility in a fraction of the time it would take manually. This reduces delays and improves the speed of claim resolution, leading to higher satisfaction. Additionally, AI can detect patterns, anomalies, and inconsistencies in data, which helps flag possibly fraudulent claims and allows insurers to mitigate fraud risks and reduce financial losses.

AI impacts the insurance customer journey by giving personalized support, streamlining underwriting processes, and expediting claims processing. Integrating AI technologies can enhance satisfaction, reduce operational costs, and improve the overall competence of insurers. As the industry continues to evolve, embracing AI becomes essential if insurers intend to remain competitive, deliver exceptional customer experiences, and drive business growth.

Incorporating AI and insurance has many possible benefits, with greater efficiency being one of the most significant advantages. When combined with digitalization (structured data entry) and automation (nonmanual processes), AI may generate cost reductions for insurers around labor-intensive and repetitive tasks, such as claims processing and underwriting. The integration of AI in insurance brings significant savings by replacing ongoing OPEX from personnel with CAPEX for machines, resulting in economies of scale. Additionally, AI enables more effective pricing by closely aligning it with the expected claims experience, thus minimizing the risk of lost business from overpricing or reduced margins from underpricing. Moreover, AI-driven systems eliminate human error in pricing, ensuring more accurate and competitive offerings.

AI-powered insurance processes offer numerous benefits to customers. Faster process times enabled by automation streamline policy issuance, claims processing, and service, resulting in quicker turnaround times and better customer satisfaction. Continuous engagement through AI-driven virtual assistants and personalized communication facilitates a seamless and tailored experience, providing timely support and information to policyholders. Furthermore, the potential of AI extends beyond current capabilities, enabling possibilities that may be difficult to envision today. For instance, in the context of traffic accidents, AI-powered insurers could leverage telematics data from involved vehicles to determine liability and promptly settle claims, possibly eliminating the need for extensive paperwork, police reports, and lengthy investigation processes, thereby revolutionizing the claims-settlement landscape.

However, using AI in this industry also comes with challenges:

It is crucial to delineate clear boundaries and strike the right balance between AI and human involvement. Other implementation hurdles of AI that demand consideration are: substantial CAPEX, the availability of high-quality data sets, the establishment of a robust technological foundation, and other infrastructure considerations.

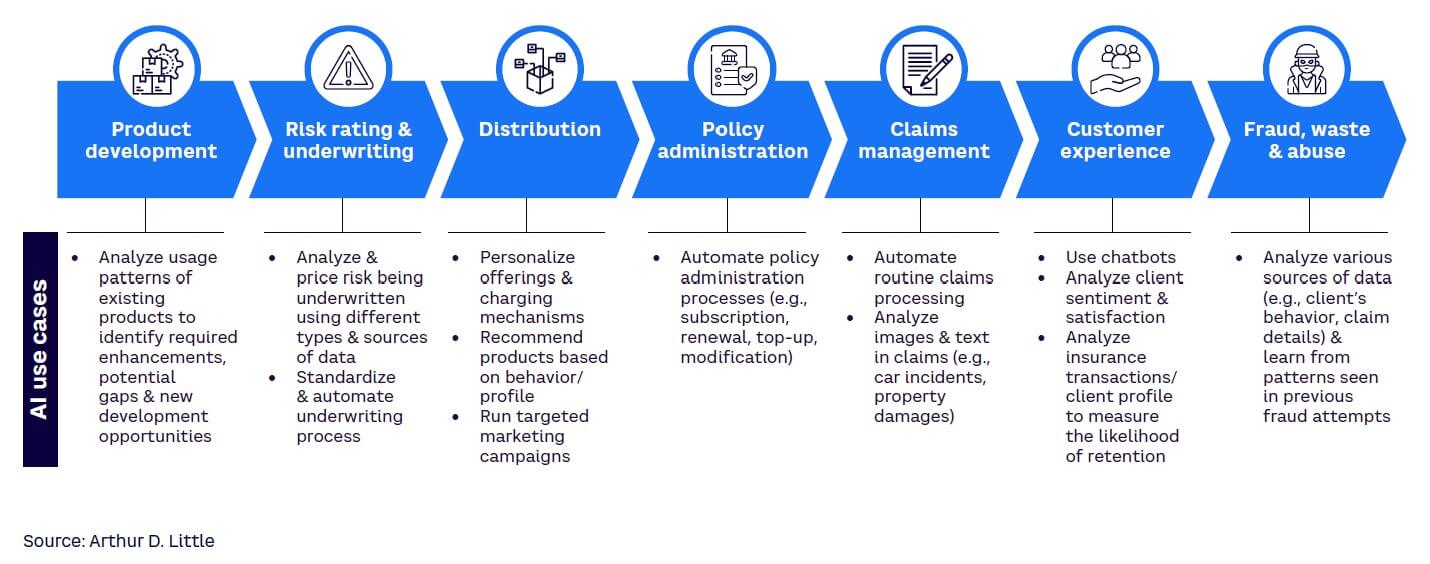

There are numerous examples of successful AI utilization within different insurance products and during different stages of the value chain (see Figure 3). For instance, Ping An, a Chinese insurer, uses AI to tailor insurance products with the aim of increasing loyalty and increasing overall sales. The company has developed an AI-powered system called “OneConnect” that uses ML algorithms to analyze data and develop personalized insurance recommendations. These algorithms also customize offerings to match the client’s needs, which has greatly enhanced the efficiency of insurers’ internal analytics and campaign teams. They have also achieved a high level of automated but personal interaction, significantly improving productivity. Integrating AI and ML has revolutionized how Ping An engages with customers, enabling seamless and individualized experiences at scale.

Zurich Insurance’s AI-powered system, called “Zara,” uses ML algorithms to automate claims processing. The system reviews data from various sources, including images, videos, and audio recordings, to assess claims more accurately. Zara is also able to detect potential fraudulent claims by identifying patterns that indicate fraudulent behavior. Zara’s implementation has reduced processing time by more than 30% and allowed claims to be filed around the clock. The new system has also significantly reduced the time between claims and payouts and grew customer satisfaction to more than 80%.

The insurance industry has also found that AI offers faster and more accurate customer service. “Pocket Agent,” State Farm’s AI-powered chatbot, assists with a wide range of inquiries, including policy information, claims, and billing. The chatbot uses NLP to understand inquiries and provide relevant responses. It can offer recommendations based on customer history, preferences, and additional data. Unlike traditional offerings, Pocket Agent is available 24/7, which means that customers can get assistance whenever they need it. Chatbots decrease the workload in contact centers by up to 30% while offering convenience to digitally oriented clients.

AI can transform the insurance industry by improving efficiency, accuracy, and customer service. However, data and AI create challenges for insurers. By using these technologies ethically and transparently, insurers can develop better products and services, grow their bottom line, and remain competitive in a rapidly evolving industry. It will be exciting to watch insurers leverage AI across use cases. CEOs should consider five actions:

By José González, Andreas Buelow, Bohumil Hyánek, Dr. Nawaf Almaskati, Sara Nasaif