1 Introduction to Specialty Lending

For more than ten years, a clear structural trend has been emerging under which an increasing share of the credit market is no longer transacted via banks but via other market participants. For larger volumes, this is primarily the liquid capital market via syndicated loans or listed bonds. In the mid-market, on the other hand, private debt solutions are used: Direct Lending in particular has established itself as a financing alternative and meets the need of institutional investors to tap alternative sources of income. However, the financing purposes are not broadly diversified; the clear focus of such strategies is predominantly on corporate loans in the context of leveraged finance, i.e. the financing of private equity acquisitions. This segment of the market has a number of positive attributes that make it sustainably attractive from an investor's perspective. The segment is now established, a wide range of fund providers are active, a longer performance history is available and market transparency is now quite high. Although the investment logic of Direct Lending is very coherent - the sustainable profitability of the companies financed as the main credit basis (so-called "cash flow lending") - it should not be neglected that this is only a narrow view of the credit market. From a portfolio management perspective, it should be noted that over 80% of capital is related to private equity market activity, and investors are thus ultimately subject to the dynamics in this area via an exposure to Direct Lending.

A wide field of financing topics is not served by these funds at all, which can be divided into the segments Consumer, Commercial, Real Assets, Corporate, and other Niche/Esoteric Assets. Overall, the credit philosophy here follows an "asset-based" approach, in which recoverable assets secure the loan. These can be tangible, physical assets such as real estate, or financial assets such as short-term loan portfolios.

Diagram 1:Specialty Lending sectors

Source: YIELCO, August 2021

Within these sectors, the majority continues to be bank or capital market-oriented, investment-grade related volume businesses. Specialty Lending comes into play precisely where complexity prevents necessary financing requirements from being processed quickly and efficiently. An individual approach is required here, with significantly more intensive, detailed credit analysis and bilateral, tailored structuring. Any risks are mitigated by the senior position in the capital structure, asset protection and additional collateral or guarantees. By their very nature, such financing solutions tend to be used in selective niche situations. Fund managers who specialize in this strategy and actively seek investment opportunities in these gaps in the credit market have a good starting point for implementing favorable credit protection and negotiating comparatively high interest rates or total returns including fees - usually of above 10% p.a. – due to limited competitive dynamics. For the borrowers, these financing costs are economically rational because they are the only way to realize a project or business plan, e.g., when under time pressure, while still achieving attractive returns on equity. In many cases, these costs only have to be borne temporarily, as a specialty finance solution can often be refinanced much more cost-effectively after 2 or 3 years when perceived risks have reduced, condition normalized or the business has scaled substantially.

2 EXAMINATION OF THE RETURN/RISK PROFILE

2.1 Challenges and data basis

The question arises as to which return and risk characteristics this investment strategy can demonstrate on a broader statistical basis and over a longer historical period, and whether the indicated level of return is not acquired at the cost of increased volatility and significant loss experience. It is quickly evident that there is a lack of established time series data for relevant benchmarks. Even among the relevant data providers in the alternatives/ private debt sector, Specialty Lending is not listed as a separate category or can be singled out easily. Especially in comparison to other private debt strategies such as Direct Lending, there is a high degree of market intransparency, which is also due to the heterogeneity of the various individual strategies.

As a result, YIELCO initiated its own empirical study based on proprietary, transaction-level data from its in-house, due diligence analyses of fund managers in the segment over the last several years. The dataset comprises around 2,800 individual transactions with an investment volume of USD 55 billion from 145 funds within a meaningful observation period of 15 years.

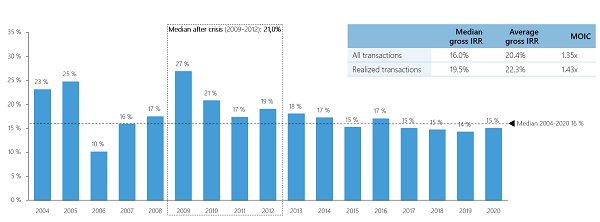

2.2 Return

Based on this data, the median IRR is 16% p.a. for all considered transactions. Over the last 10 years, the returns of the individual vintages are consistently in a range between 14-19%. Earlier investment vintages show even higher return levels of 20%+ in some cases, which is partly due to a higher share of realized transactions where the additional variable return components are already fully reflected. On the other hand, the influence of the market cycle can also be seen to some extent in the fact that particularly favorable entry phases have led to very attractive results, as can be seen in the returns of 2004 or 2009-10.

Diagram 2:Gross returns by transaction year

Source: YIELCO, August 2021; Based on a database of 69 managers, 145 funds and 2783 transactions with a cumulative investment volume of USD 55.5 billion from 1997-2019; Median returns.

Conversely, it also shows that the strategy can deliver a solid performance in difficult times. In particular, the investment timing prior to the financial crisis or recession of 2008/09 - i.e. the 2006-08 vintages - provides information on the extent to which Specialty Lending is negatively impacted by general market developments. Thus, a portfolio diversified in time over these unfavorable three years would have generated a return roughly on par with the long-term average and even in each individual year would still have generated a gross return at least close to double digits.

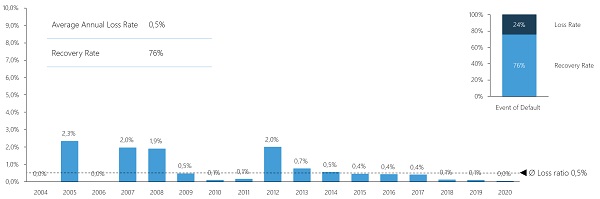

2.3 Risk

These attractive results on the return side with low volatility over time confirm two key elements of Specialty Lending strategies: (1) Stable, higher-yielding, interest-oriented sources of incomeand (2) significant risk mitigation that avoids binary risk. To this end, it is worth taking a closer look at the loss rates incorporated in the previously listed returns. The study shows that these are consistently at a low level (long-term median at 0.5% p.a.) and that the extent is limited in the event of a loss. In the event of a default, on average, a recovery rate of 76% can still be achieved. Thus, the risk parameters do not differ substantially from the frequently quoted long-term empirical values from the Direct Lending/leveraged loan market. It should be noted, however, that the downside protection in the market segments mentioned is structured very differently. While in the latter case the cash flow lending concept, and thus also the conservatively measured enterprise value, is the determining factor in a stress scenario, loss avoidance in Specialty Lending as an asset-based lending philosophy is fundamentally related to security over recoverable assets, that are at the forefront of structuring and sizing the loan.

Diagram 3:Distribution of annual loss rates over time

Source: YIELCO, August 2021; Capital-weighted annualized loss rates (assumption of average three year credit duration).

When the high-level observations are broken down into the development of default rates over time, a particularly remarkable picture emerges: the losses are distributed quite evenly over the years. This is initially surprising, as in the case of risk assets such as high-yield bonds, the credit and economic cycle can be expected to have a significant impact on loss rates and thus on the returns achieved. Even though the data used in the analysis show a certain spike of defaults on loans taken out before the financial crisis of 2007/08, which then impacted their value, it should be noted that the losses suffered remained clearly limited and had only a very moderate negative impact on returns.

This analysis clearly shows that any perceived risks that may have been suspected due to the level of expected returns in Specialty Lending have not materialized to any significant extent in the past. Downside protection via collateral with an adequate margin of safety prevents high losses in the event of a default. The hypothesis that Specialty Lending is more akin to an equity-like strategy with binary pay-offs can thus be firmly rejected.

The empirical study explicitly does not include data from more recent loans on which the current 2020/21 COVID crisis has had an impact. This is a systematic challenge of data collection, which is only ad hoc when fund managers are assessed and not on an ongoing basis - at least not on a comparable scale that allows a statistically significant conclusion to be made as of today yet. However, YIELCO has tracked the performance of selected funds in more detail quarter by quarter in 2020. A positive bias cannot be ruled out in the results, as YIELCO believes that these are high-quality managers who have been flagged as due diligence candidates for potential future investments. In broad terms, however, the trend should be indicative for the strategy overall: fund performance was clearly positive, reaching 105 in Q3 2020 (compared to a baseline in Q4 2019 indexed at 100). In this context, Q1 2020 was also slightly positive, which would have been suspected to show negative valuation changes in light of market turbulences. Similarly, gross IRRs at portfolio level held relatively steady at 15-16% in each quarter. Thus, the key observations over the longer term could be confirmed, at least selectively, also in the current market environment.

2.4 Correlations

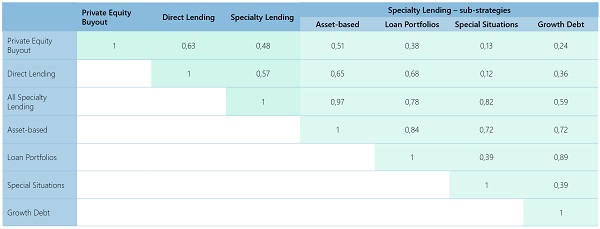

Returning to the long-term time horizon, we would like to conclude by discussing the strategic portfolio contribution of Specialty Lending, that can be achieved for investors if the strategy is included in their asset allocation. In addition to the attractive risk/return profile described above, a substantial diversification effect compared to other alternative investments, primarily private equity and direct lending, can be expected. The differences in thematic focus and asset collateral for downside protection explain a very muted correlation - 0.5 and 0.6 respectively.

Diagram 4:Correlation of gross IRRs

Source: YIELCO August 2021; 2004 - 2019; direct lending and private equity buyout data from CEPRES database.

The second finding is that the Specialty Lending market does not represent a homogeneous strategy and that various sub-segments can be identified in terms of specific use cases. These tend to have low correlations with each other - with otherwise similar credit philosophy, return and risk structure as common denominators. Consequently, access to this strategy can be optimized if different strategy approaches are combined. The attractiveness of the segment as a whole is amongst other factors related to the fact that smaller managers can address market niches with their specialist expertise and can therefore exploit complexity and market inefficiencies to their benefit. However, this also means that such funds are often more concentrated thematically and thus may be more affected by specific sector trends. Hence, a broader, diversified portfolio approach in Specialty Lending appears best suited to tap the potential of the strategy without being overly exposed to individual themes.

3. CONCLUSION

Private debt as an asset class has now established itself as an important portfolio component in the asset allocation of institutional investors. The focus is on generating reliable, interest-oriented returns in order to meet the challenges of the capital market environment in the area of traditional fixed income investments. In recent years, the focus has been primarily on (corporate) Direct Lending as a first step. To diversify these established alternatives portfolios, other market segments are increasingly being taken into account, in particular to reduce the sensitivity to private equity as the primary driver of these corporate loans.

Specialty Lending is proving to be an attractive strategy within private debt that can be used to enhance a portfolio´s quality. YIELCO's empirical evaluation shows that interesting risk-adjusted returns can be achieved, the majority of which are based on contractual yield. The distribution of returns over the years shows only very mild cyclical dependencies. Accordingly, risk defined as realized losses is limited and did not show significant spikes in times of crisis. High downside protection through a senior secured position and asset collateral are largely responsible for this. With these positive characteristics, Specialty Lending is a very favorable portfolio addition in the alternative credit sector - a trend that is already being taken up and implemented much more widely outside Germany and Europe.

Contact information:

Börge Grauel

Co-Head Private Debt

Konstantin Schuster

Investment Manager

Konstantin.schuster@yielco.com