Rapid growth of generative artificial intelligence (GenAI) has unlocked significant opportunities in the communications platform as a service (CPaaS) space, with those able to harness its potential poised to strategically differentiate. Leveraging GenAI facilitates dynamic solutions that offer context-specific experiences for end users — revolutionizing current offerings. But how should CPaaS players approach such an opportunity, and what are the impacts for the wider ecosystem? To answer this, this Viewpoint explores GenAI foundations, uses cases, and myriad impacts for CPaaS markets.

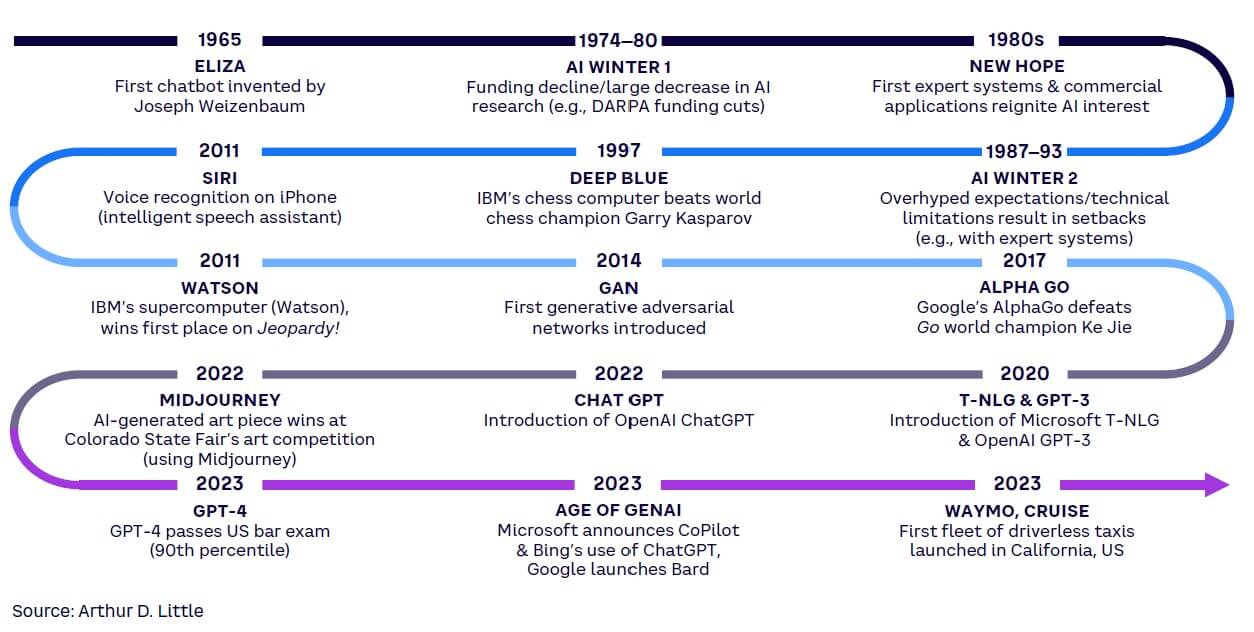

AI and machine learning (ML) have existed since the last century, but as shown in Figure 1, development has accelerated in the past decade (most notably the past few years), with four trends driving growth:

The potential to gain a competitive edge is sparking AI market adoption, including its solution/capability maturity, rapid use-case implementation, and increasing consumer readiness for AI. Beyond core use cases, AI exhibits radically transformative capabilities in newly emerging applications across industries. For example, Accor, Europe’s leading hospitality group, leveraged AI to automate time-consuming tasks, optimize resource allocation, and adjust pricing to meet demand volatility.

The result: strengthened customer loyalty via AI-customized recommendations.

As explored in the Arthur D. Little (ADL) Blue Shift Bulletin, “A Guest Role for AI,” AI technology has the potential to address key challenges faced by enterprises by making sense of large volumes of data. Such benefits are mainly derived via three techniques:

Beyond these foundational techniques, AI empowers data management through automated data cleansing and anomaly detection, ensuring high-quality data that fuels accurate algorithms and insightful decisions. Advanced natural language processing (NLP) lets AI extract meaning from unstructured data like text and images, enriching the information landscape for insightful analysis.

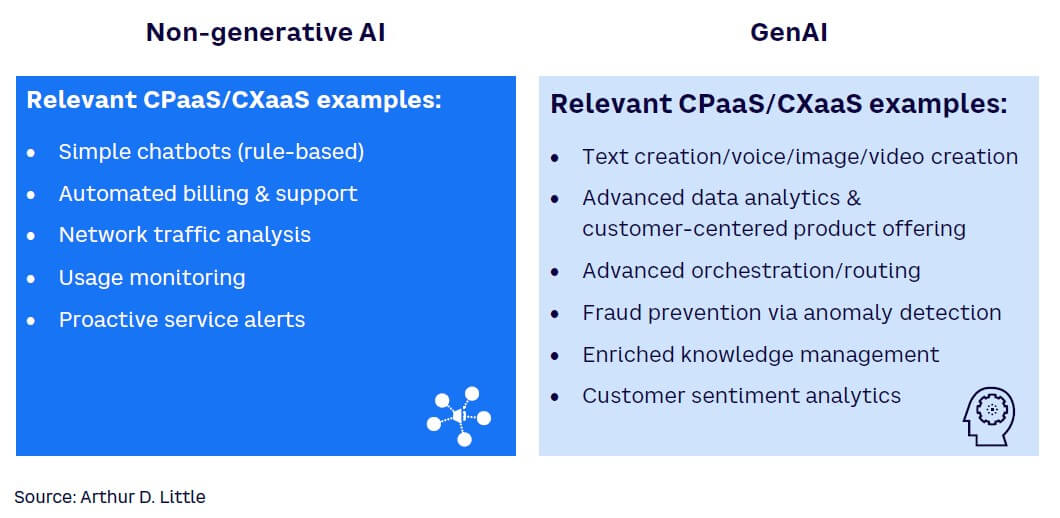

A simplified distinction of non-generative versus GenAI can be used to provide a framework for AI comparison:

Initially, AI in CPaaS was limited to basic chatbot/voice-recognition functions such as automated responses to common queries. Today, as GenAI unlocks more advanced CPaaS/CXaaS (customer-experience-as-a-service) applications, it is driving market hype and serving as a key source of future value for CPaaS players (see Figure 2).

Specifically, GenAI presents a unique opportunity for CPaaS providers to develop enhanced offerings. By developing dynamic/interactive solutions that engage in a personalized, context-specific fashion, CPaaS providers can enhance end-user experiences, overcome the limitations of one-size-fits-all content, and foster deeper customer connections. GenAI’s ability to define rules for learning/adaptation over time facilitates continuous optimization of CPaaS offerings, ensuring differentiated market positioning for companies that master it.

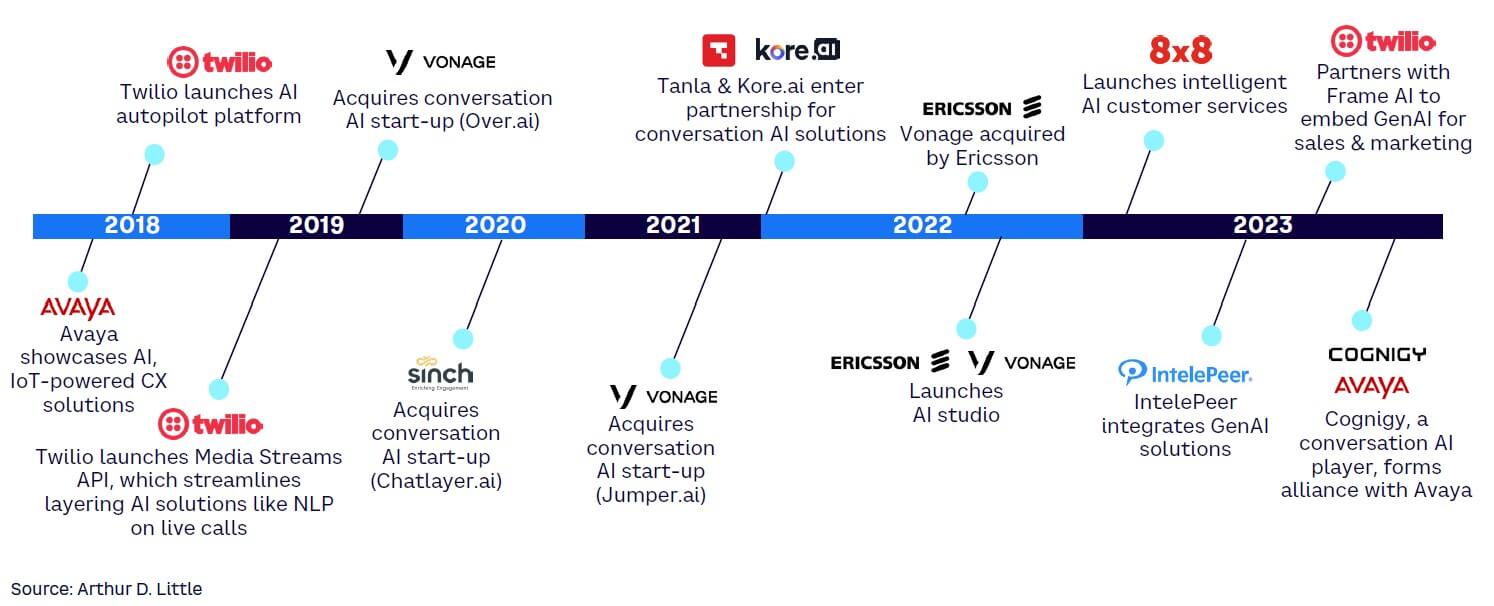

Various CPaaS players are starting to venture into the AI space (see Figure 3). CPaaS solution providers have initially taken the lead. Twilio’s announcement of its 2023 partnership with Frame AI to extend its customer data platform (CDP) solutions is a good example of integrating GenAI capabilities into CPaaS offerings. Leveraging Frame AI’s consumer intelligence platform/capabilities, Twilio is poised to extend its existing solution suite to customer-intention and case-severity analysis. This will help Twilio’s clients train models that can define and categorize customer intentions for better product decisions.

Other companies are emerging in this space, including IntelePeer, whose CEO Frank Fawzi highlights the huge opportunity AI presents for CPaaS players. Fawzi told ADL that CPaaS players can unlock significant potential via GenAI-enabled communication-automation platforms. “Recent experiences of enterprise customers show more than 80% of call center traffic opting for GenAI solutions over real agents — optimizing both operations and experiences,” said Fawzi.

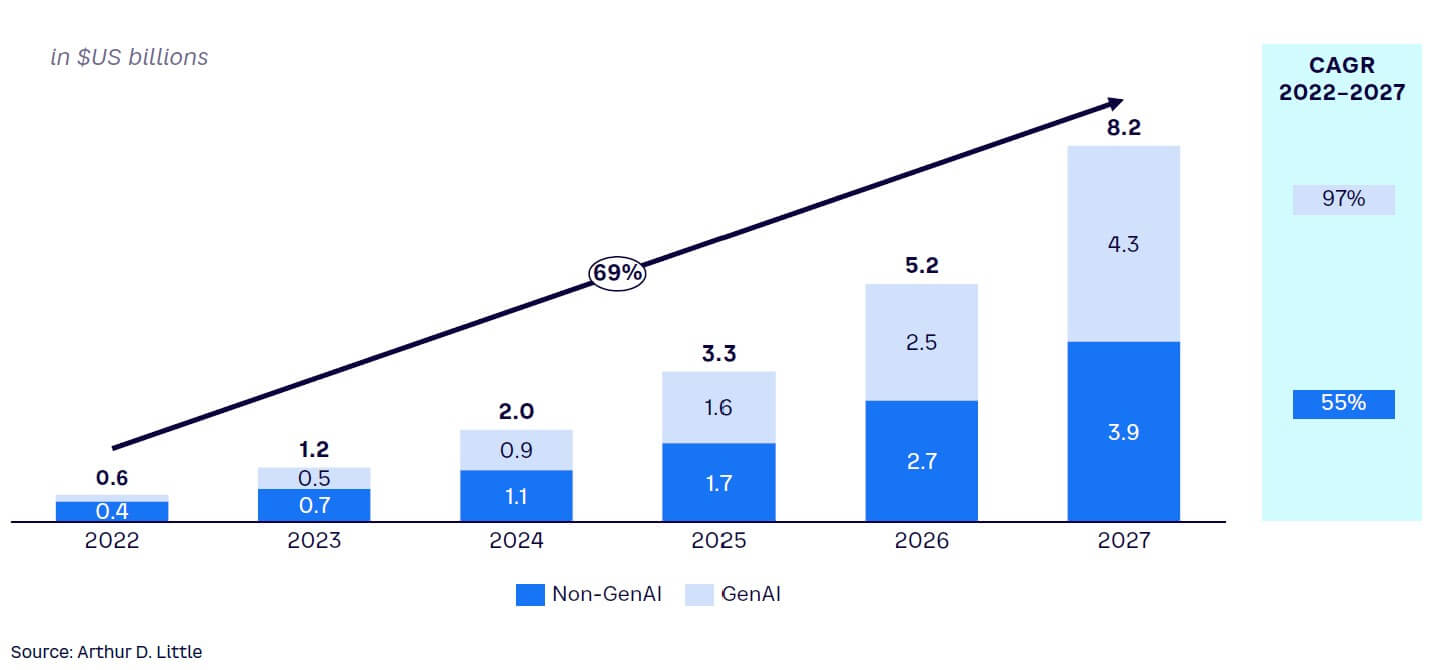

As a result of these applications, GenAI is positioned to be one of the fastest growing subsegments within the global CPaaS market and is expected to reach approximately US $4.3 billion by 2027, representing approximately 6% of the global CPaaS market (forecast to reach $68.6 billion by 2027). These estimates stem from market expectations that as the technology matures, CPaaS market penetration will follow a ripple effect toward GenAI solutions (see Figure 4).

Although non-generative AI is expected to grow and remain important in the global CPaaS market (reaching approximately $3.9 billion by 2027), GenAI is identified as the key value source for CPaaS players in the coming years.

It is relevant to note that the scale of AI adoption within the CPaaS domain is dependent on overcoming potential hurdles across the market, including customer readiness, investment returns, and regulatory risks. Despite this, market trends demonstrate that customer and regulatory readiness is on the rise, with a wide-scale transition of CPaaS players to AI-powered solutions and the establishment of common AI regulatory frameworks (e.g., EU AIA). Furthermore, top-performing implementations can break even on initial investments within less than six months — presenting a highly attractive ROI for AI solution investment.

Of course, CPaaS players must be mindful about which segment(s) to target with GenAI and should identify natural combinations/integrations of use cases for an integrated offering. Figure 5 outlines the four principal areas of application for end-user provision, with relevant market examples highlighted for each segment: