In recent years, the world of finance has been undergoing a seismic shift, driven by the rapid advancement of technology. While financial services have always been tightly regulated, the pace of regulatory changes has accelerated in recent times. Regulation now plays an even more significant role, not only shaping the industry’s trajectory but also opening new markets.

As fintech specialists, at Mouro Capital we keep a close eye on regulatory trends. In Europe, 2023 has seen an increasing regulatory scrutiny on key areas such as Banking-as-a-service and proposed regulation for AI. 2024 promises to be another important year for financial services regulation, with a proposal update of PSD2 (the Payment Service Directive, which de-facto led to the creation of open banking) expected before the end of the year. While this would effectively only take effect around 2026, we look at some regulations which are expected to come into effect this year or be evaluated soon, which have the power to shape the fintech ecosystem.

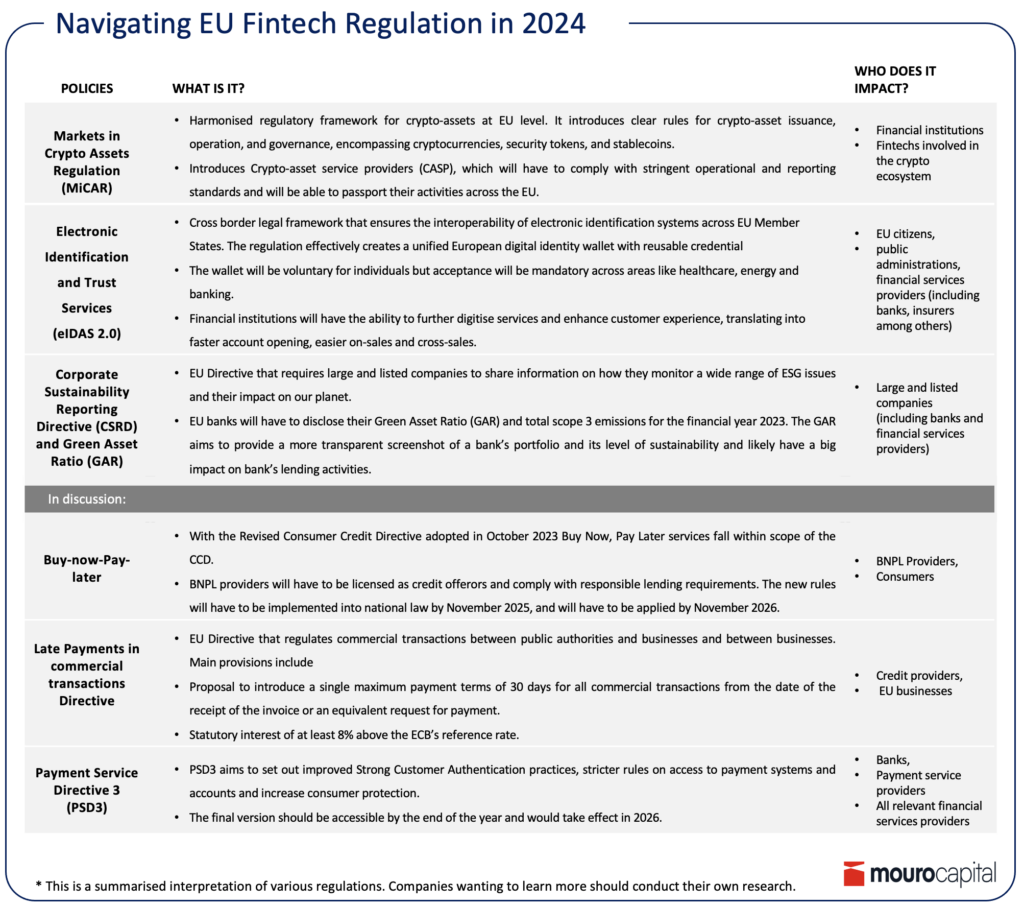

MiCAR marks a milestone as the first comprehensive set of regulations for cryptocurrencies. Starting from June 30, 2024, MiCAR introduces clear rules for crypto-asset issuance, operation, and governance, encompassing cryptocurrencies, security tokens, and stablecoins.

Regulated entities that are already licensed in the EU (such as credit institutions, investment firms and EMIs) are not required to obtain a new authorisation to act as Crypto-asset service providers (CASP) but need to register as a CASP with their supervisory authority.

CASP will have to comply with stringent operational and reporting standards and will be able to passport their activities across the EU.

We believe Europe’s Electronic Identification and Trust Services (eIDAS 2.0) has the opportunity to revamp the way we manage digital identity and have written in-depth here.

The regulation effectively creates a unified European Digital Identity with a digital identity wallet as a key component. The wallet will have a reusable credential model, meaning that it can be rolled out every time we’re asked to credentialise ourselves. While the wallet will be voluntary for individuals, most public and private sector bodies that want our information will be required to use strong authentication protocols for online identification and accept the wallet as a means of doing so. And, consequently, its acceptance will be mandatory across areas like healthcare, energy, and banking.

For the customer this means greater control, security, and data privacy. Financial institutions will have the ability to further digitise services and enhance customer experience, translating into faster account opening, easier on-sales, and cross-sales. The European Commission impact assessment study estimates savings from more efficient onboarding ranging between $860 million and $1.7 billion on a yearly-basis and reduced fraud savings between €1.1 billion and €4.3 billion.

The Corporate Sustainability Reporting Directive (CSRD) is a EU directive that comes into force on January 1, 2024. It requires large and listed companies, to disclose details related to their monitoring of ESG matters and their effects on the environment. This signals a significant shift in reporting standards, impacting a larger number of companies (from 11,000 subject to NFRD requirements to 50,000), more extensive disclosures and heightened stakeholder scrutiny.

In addition to the CSRD which effects players across all industries, from January 2024, EU banks will have to disclose their Green Asset Ratio (GAR) and total scope 3 emissions for the financial year 2023. This means that banks will need to provide quantifiable evidence that demonstrates the extent to which the activities they finance meet what the EU Taxonomy defines as sustainable.

Up until now banks’ climate ambitions and commitments have mainly consisted of redirecting capital towards green investments or reducing their long-term investments in fossil fuels (and failing in most cases!). The GAR aims to provide a more transparent screenshot of a bank’s portfolio and its level of sustainability and likely have a big impact on bank’s lending activities.

While the above are regulations which are taking effect in 2024, there are others which are currently in discussion or in the proposal phase which we believe have strong impact on the fintech industry:

The European Union’s financial regulatory framework lacks uniformity when it comes to regulate Buy Now, Pay Later. The current system, governed by the Consumer Credit Directive (CDD), does not typically apply to the prevalent credit structures used by BNPL providers. This his is especially evident in credit arrangements entailing a total credit sum below €200, as well as interest-free credit agreements requiring repayment within three months.

With the revised Consumer Credit Directive adopted in October 2023 Buy Now, Pay Later services fall within scope of the CCD in most circumstances. This means that BNPL providers will have to be licensed as credit offerors and comply with responsible lending requirements. The new rules will have to be implemented into national law by 20 November 2025, and will have to be applied by 20 November 2026.

The EU initially addressed late payments in 2011 by instituting a 30-day payment term for business-to-business transactions, with the provision for extension up to 60 days or beyond “if not grossly unfair to the creditor”. However, this has resulted in a payment culture where large clients often impose payment terms of 120 days or longer on smaller creditors.

The new directive proposes to introduce single maximum payment terms for all commercial transactions, including transactions between public authorities and businesses.

Alongside the 30-day limit, debtors will automatically incur late payment interests on overdue sums (set at 8% above base rate) and agreements between parties to waive such interest is prohibited.

While still only at the drafting stage and awaiting enactment, this proposal has been met with a mixed reactions due to limitations to mutually beneficially agreements between parties and its potential impact on reducing supply chain financing opportunities.

In 2015, PSD2 de-facto led to the creation of open banking, enabled Banking-as-a-Service and led to cost decrease. Its updated version which aims to improve competition and innovation in the financial industry is expected to set out improved Strong Customer Authentication practices and stricter rules on access to payment systems and accounts.

The new proposals also include a new Payment Services Regulation (PSR) to improve consumer protection. The final version should be accessible by the end of the year and would take effect in 2026.

In conclusion, the evolving regulatory landscape in the fintech sector opens interesting investment opportunities that ride such innovation waves, in areas such as on-boarding and verification, data interoperability, decentralised platforms and green finance solutions.

We are particularly excited about Europe as a hotbed of regulatory innovation and to some extent a standard-setting ecosystem that other markets in the world may follow.