At Nauta Capital we are excited about the insurtech space, having recently invested in InsureQ and Weecover, and hoping to make more investments in the space soon. After months of deep-dive and gathering a significant amount of data, we have decided to share some findings from our research and reflections on the space.

The Insurance Industry

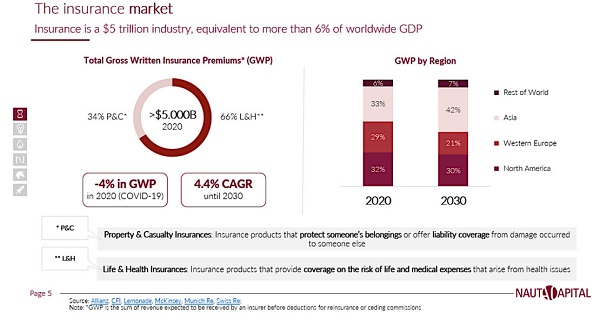

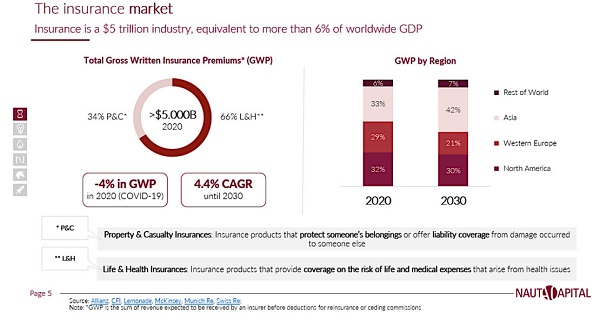

The insurance industry is one of the largest industries in the world, representing >$5tn in Gross Written Premiums (GWP) globally in 2020 and expected to keep growing at a 4.4% CAGR until 2030. Despite that, the industry is experiencing a massive transformation due to the need to adapt to the changing environment: new customer needs, change in customer purchase behaviour, need for flexibility, among others. The entire insurance value chain, as well as the internal processes happening within traditional insurance companies, are ripe for disruption and this is where insurtech companies come into play.

The Insurtech Ecosystem

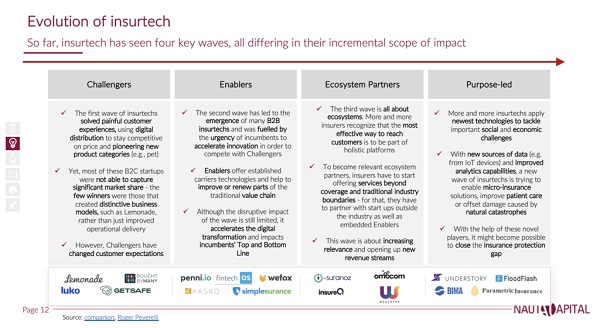

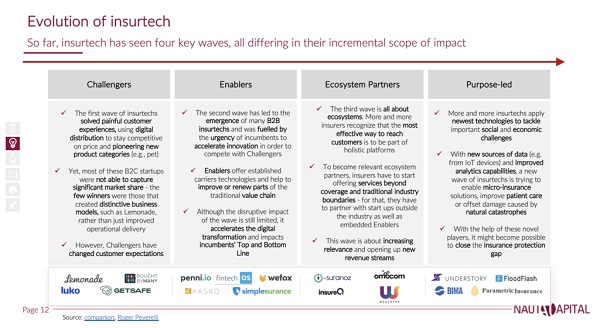

Similar to banking tech and the neobanks, the disruption first focused around digital distribution of cheaper products with better customer experiences and new product categories, however over time the focus has spread through the entire value chain as innovation cuts deeper into the traditional model.

Industry struggles and challenges

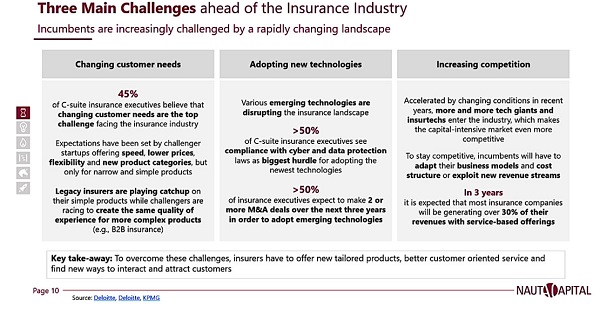

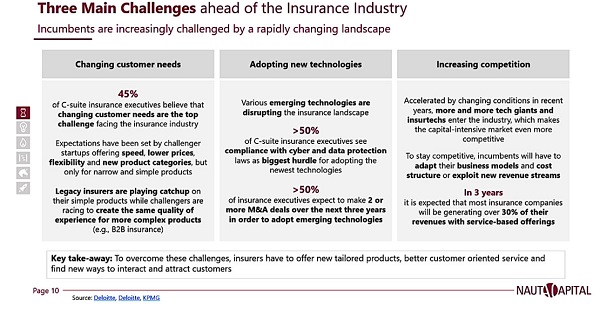

Today there are a number of key challenges that persist in the industry. Namely:

- Increased customer demands and the expectations for consumer-grade customer experience on all products, not just narrow and simple products which have been covered already

- Increasing competition from challengers, legacy providers, as well as new market entrants such as Big Tech companies and manufacturers. Innovating new products efficiently will require faster feedback cycles, investment and better technology from the legacy providers

- Adopting new technologies for legacy providers to compete with challengers and new entrants is difficult but essential to survive

The majority of ‘hype’ and venture investment in Fintech initially surrounded payments and banking tech, however, investors and entrepreneurs have been lured into insurtech, where capturing even a small share of the huge market is lucrative enough to justify the considerable investment.

Trends & Opportunities

Nauta has identified a number of trends and opportunities in the industry that will be important for future years:

- SME underinsurance: Previously underserved due to the high admin and distribution costs, distribution through digital channels and software-empowered operations allow insurers to serve this segment efficiently. This represents a huge market opportunity, and we have already picked our champion.

- Embedded insurance: embedded insurance allows insurers (both full carriers or MGAs) to offer insurance products to prospective policyholders by embedding their sales process into the checkout of a third party, reaching customers at the optimal time and pre-empt competition. Embedded Insurance is a unique way of placing insurance products when customers are most concerned about risks, right at the moment of the purchase of a product, service or platform instead of being sold ad-hoc. This new trend, even though still emerging, is already considered strategic by retailers and digital platforms, as it implies (i) having the possibility to provide insurance products alongside their core products or services in a non-intrusive and easy-to-integrate manner, and (ii) generates an additional, and very profitable, revenue source in the business. We believe Embedded Insurance will become massive in the coming year and one of our companies is very well-positioned to lead the ride.

- Open insurance: To compete with modern challengers legacy providers will have to open their tech stack through an API layer to take in and send out data that will allow them to improve the delivery and distribution of their products through partnerships. An example use case might be to ingest data from a retailer to screen a prospect or price a policy, rather than require the prospect to input the data themselves). This will lead to a rise in Insurance APIs usage but presents GDPR difficulties. To date, most insurance APIs have related to distribution, but there is an opportunity to ingest data, for example, to monitor insured assets and allow better usage-based policies or to help policyholders prevent losses by alerting them when necessary.

- Parametric insurance: attractive due to the heavily reduced administration cost and faster payout the parametric insurance model allows insurers to insure losses that would otherwise be extremely hard to insure, such as natural disasters.

- Covid-19 effect: despite being a historic loss event investment has increased and pressure to innovate and digitise has increased

- Big Tech enters the market: leveraging their huge customer base, Big Tech companies (Google, Amazon, Apple, Tesla) have leapt on the opportunity to enter the insurance value chain

- Moving from the simple to the complex: most innovation has been for simple products and silo’d into narrow categories, predominantly in the B2C customer segment. However, a large part of the market remains untouched by disruption but requires more complex policies and processes to be innovated upon. These are harder problems to solve and may need to be tech-enabled, rather than fully automated, but present a huge opportunity.

For more information on the above trends please see the full report which features:

- Definitions and background on the insurance industry

- An overview of the insurtech ecosystem

- Market trends and opportunities

- Deep dives on notable insurtechs – available on request

- Venture funding activity and market maps – available on request

- Our investment thesis for the space

If you prefer pictures to words you can see the full report in PDF format here.

Please note that this is a shortened version. The Extended Report is available on request