In today’s rapidly evolving financial landscape, there is an undeniable imperative for financial institutions to take a leading role in advancing a low-carbon economy. In this Viewpoint, we delve into the pivotal role of financial institutions, from realigning lending policies to integrating climate risk assessments. We explore the challenges and strategies essential for banks to reduce carbon emissions and ensure their resilience and prosperity in this transformative era.

Financial institutions are under mounting pressure to take a proactive role in decarbonizing their portfolios and actively facilitating the broader carbon transition within the economy. In response to the objectives outlined in the Paris Agreement, numerous banks have made public commitments in recent years to reduce their financed emissions, which are generated when they do business with carbon-emitting companies. However, the practical steps to realize these carbon-reduction targets represent a common and intricate challenge, particularly from a lending perspective.

One noteworthy aspect of this challenge is the need to expand upon traditional risk assessment practices. Banks are increasingly required to broaden their assessment criteria to include a thorough evaluation of their clients’ climate-related risks and sustainability. This comprehensive evaluation framework is vital for banks to not only achieve their carbon-reduction goals but also to support the broader aim of a sustainable, low-carbon economy.

This shift in the banking industry marks a significant moment, highlighting both the growing awareness of climate-related risks and the industry’s dedication to fostering a sustainable future while maintaining financial stability. As banks navigate these uncharted waters, a combination of innovative strategies and risk assessment methodologies will be key to fulfilling the dual objectives of reducing financed emissions and maintaining business profitability.

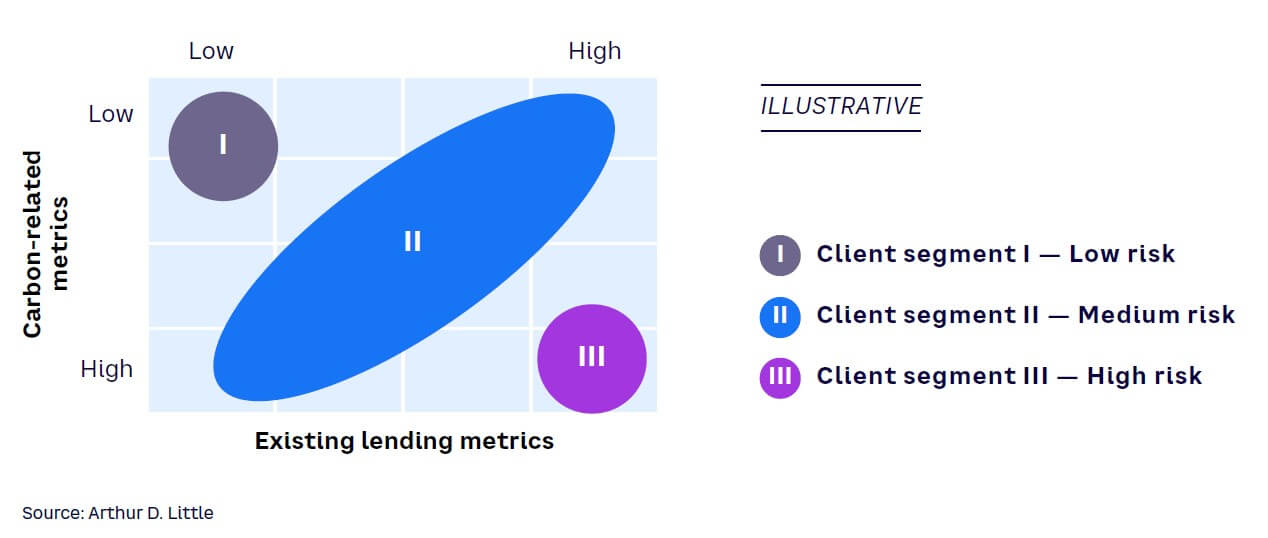

A bank’s lending operations can apply a dual-dimension matrix approach to integrate climate risk assessment into the existing risk management framework during the lending process (see Figure 1). The approach essentially incorporates a modicum of climate risk into banks’ existing lending evaluation metrics and allows banks to further segment clients to make more informed lending decisions.

Various carbon-related evaluation metrics come into relevance when reviewing clients or cases, including the client’s industry and carbon emissions. In our view, banks navigating these metrics must consider three key strategies to make a sound climate and sustainability assessment:

For financial institutions, the practice of conducting Scope 3 financed emission accounting serves as a foundational pillar for evaluating climate risk within lending processes. At its core, measuring the financed emissions of a portfolio has a pivotal role, providing the foundation upon which financial institutions can conduct scenario analyses, establish clear targets, inform strategic decision-making, and transparently report their progress. These interconnected elements collectively assume a central position in aligning portfolios with decarbonization objectives.

The Partnership for Carbon Accounting Financials (PCAF) offers a robust standard for banks. A financial industry–led initiative, PCAF helps financial institutions assess and disclose greenhouse gas (GHG) emissions resulting from loans and investments. It provides detailed guidance for each asset class, enabling financial institutions to calculate the financed emissions resulting from activities in the real economy that are funded through lending and investment portfolios. Notably, over 430 banks managing assets exceeding US $93 trillion have embraced PCAF’s methodology to calculate financed emissions.

During the lending-evaluation process, clients’ carbon emissions become a vital metric within the dual-dimension matrix approach. Upon the completion of carbon accounting, banks can utilize the financed emission data, in both absolute and normalized terms, together with existing lending metrics to drive lending decisions. In practice, absolute emissions serve as the foundational baseline for climate-action alignment with the objectives of the Paris Agreement. If a client’s absolute carbon emissions significantly exceed industry benchmarks, the result may trigger comprehensive reviews or necessitate adjustments to their lending conditions. Normalized data, on the other hand, translates absolute financed emissions into emission-intensity metrics. Other metrics such as economic emission intensity, physical emissions intensity, and weighted average carbon intensity (WACI) may also be applied to provide a multifaceted evaluation.

Additionally, leveraging accumulated carbon emission data over time empowers financial institutions to evaluate a client’s historical carbon-reduction performance. Even when clients exhibit carbon emissions that are higher than industry average at a single point in time, the stability of emissions reductions over previous years can be viewed favorably and reflected in lending condition adjustments. Assessing a client’s carbon-reduction efforts can be benchmarked against internationally recognized scenarios, such as those outlined by the International Energy Agency (IEA) and the Network for Greening the Financial System (NGFS). Alternatively, financial institutions can craft their own exploratory scenarios and carbon-reduction pathways for a comprehensive comparative analysis.

Systematically integrating financed emissions into climate risk assessment and lending procedures empowers financial institutions to achieve a thorough grasp of their carbon footprint. A methodical approach aligns portfolios with the broader goal of a sustainable future. Ultimately, this information equips financial institutions to address climate change and promote the transition to a sustainable, low-carbon economy.

The financial services industry is increasingly embracing the use of internal carbon prices (ICPs) as a proactive approach to manage climate-related risks and prepare for the transition toward climate neutrality. ICP is essentially a pricing mechanism employed by organizations to assess the financial implications of potential changes in investment, production, and consumption patterns and the costs associated with emissions-reduction efforts and technological advancements.

Financial institutions primarily employ two types of ICPs: shadow price and internal fees. The shadow price represents a theoretical cost that is not directly imposed but serves as a tool for evaluating the economic impacts and trade-offs related to various aspects, including risk assessments, new investments, net present value calculations, and cost-benefit analyses. Internal fees are concrete carbon charges applied to specific business activities, product lines, or units based on their GHG emissions. Currently, most institutions adopt the shadow price approach in implementing internal carbon prices.

The true value of ICP lies in its ability to manage risks and pinpoint opportunities. It provides financial institutions with a valuable tool to develop resilient strategies and implementation approaches that facilitate the transition toward a low-carbon economy. ICP acts as a valuable instrument enabling banks to include a “carbon” perspective into their existing investment and financing decision-making processes. During the lending process, considering individual carbon costs can lead to varying client and case prioritization, allowing banks to adjust lending decisions accordingly.

In the context of the dual-dimension matrix approach, ICP can be integrated with a bank’s existing risk models and indicators, such as probability of default (PD) or risk-adjusted return on capital (RAROC), to provide a holistic evaluation of a client’s credit risk that considers its climate and sustainability risk and return. For example, if a bank employs a quantitative PD risk model, it can incorporate the results of carbon accounting for individual clients and cases, along with the bank’s internal carbon price, into the financial variables of the quantitative model. This allows the calculation of adjusted default rates that account for carbon costs, thereby serving as an indicator to inform lending decisions. Similarly, banks can factor carbon costs into indicators such as RAROC, offering a comprehensive assessment that considers both the carbon and profitability aspects of lending.

As the global economy continues to shift toward sustainability, the use of internal carbon pricing will become an increasingly vital tool in the financial industry’s toolkit. Integrating ICP into decision-making processes is a strategic move that allows financial institutions to gain a deeper understanding of the climate-related risks they face. By quantifying these risks and aligning them with their existing risk models, banks can make more informed investment and lending decisions. Furthermore, ICP assists banks in identifying areas where carbon-reduction efforts can yield financial benefits, serving as a valuable guide for directing investments toward sustainable, low-carbon opportunities.

The financial services sector undeniably has a crucial responsibility in driving the global shift toward a net-zero economy. This task holds paramount importance as the world collectively strives to mitigate the impacts of climate change. Financial institutions serve a dual purpose, in terms of efficiently allocating capital and delivering essential financial services. Simultaneously, they contribute to ensuring an equitable, orderly, and just transition. The multifaceted characteristic empowers the financial sector to not only play a vital role throughout the transition process but to cooperate with various stakeholders to achieve a sustainable future.

As the world embarks on the journey toward a low-carbon economy, banks find themselves compelled to modify their lending policies to better connect to their decarbonization objectives and public commitments. One common modification to their approach involves discontinuing financing for specific categories (e.g., thermal coal) or entire industries (e.g., oil and gas). These adjustments are primarily driven by the need to mitigate the potential exposure to high-emission assets and to curtail the associated climate and financial risks. And yet, the complexity of the transition transcends mere industry categorizations. Many carbon-intensive sectors encompass high-emission assets like power plants, airplanes, and ships, which pose climate-related risks and present the financial risk of becoming stranded amid the shift toward a net-zero economy. This requires financial institutions to undertake a holistic evaluation of a client’s long-term climate risk while proactively guiding and assisting clients throughout their transition process.

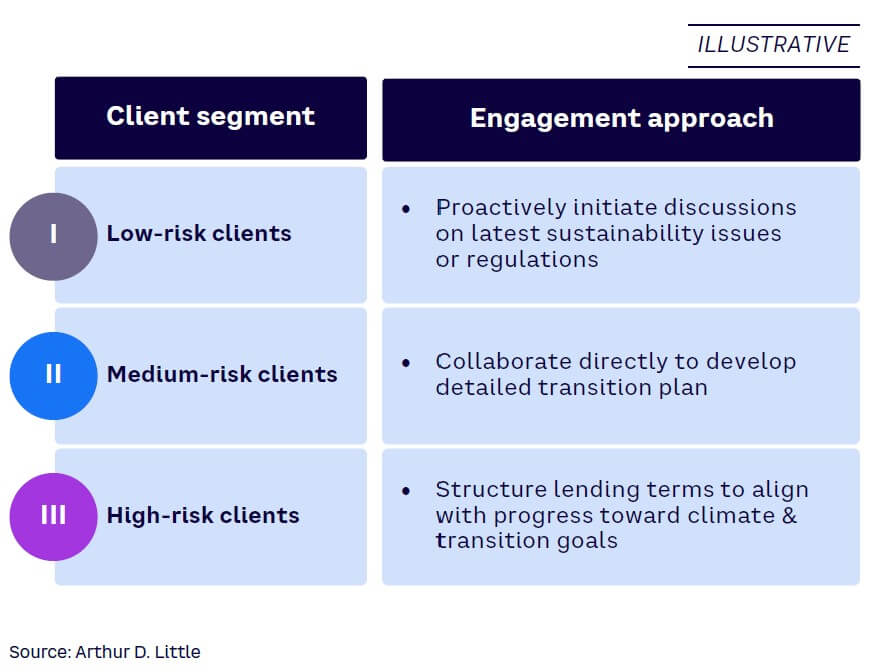

With the dual-dimension approach, banks can assist clients in achieving their transition goals by applying different client engagement approaches to different client segments, based on their carbon and non-carbon risk characteristics (see Figure 2).

For example, for the low-risk segment, banks can initiate discussions with clients on the latest sustainability issues or regulations, thereby fostering greater awareness of the subject. For the medium-risk segment, banks may collaborate directly with them to develop a detailed transition plan. The plan may outline the client’s transition goals, the specific actions they intend to take, and the degree of accountability required. Moreover, for the high-risk segment, lending terms can be structured to align with the client’s progress toward the attainment of transition goals. Such a collaborative approach not only strengthens the relationship between the bank and the client, it also has the potential to reduce carbon emissions significantly. Most importantly, it equips clients with the necessary financial resources to realize their transition efforts effectively.

Banks should evolve into partners on their clients’ journey toward sustainability. By offering support, guidance, and tailored financial solutions, they can advance the shared objectives of a low-carbon economy while safeguarding their interests in a rapidly changing financial landscape. This cooperative synergy between banks and clients is conducive to sustainable transitions and serves as the bedrock upon which financial institutions can contribute to the realization of a net-zero future.

The financial services industry is at the forefront of steering the world toward a net-zero economy. Addressing the three strategies outlined in this Viewpoint could guide the way to a sustainable future:

By Joseph Huang, Becky Chou, Darwin Hsiao, Wilson Liu