Countries across the world have set ambitious decarbonization targets. However, despite some progress, the gap between aspirations and reality is growing. Greenhouse gas emissions are rising globally, with industrial emissions proving particularly difficult to reduce. Delivering effective industrial decarbonization therefore requires additional levers, specifically carbon capture, utilization, and storage (CCUS). This Viewpoint explains the opportunities CCUS provides for businesses and its potential to address climate targets.

Following the Paris Agreement, a 2015 international treaty on climate change, countries have introduced stringent targets and deadlines to decarbonize in order to limit the rise in global temperature to well below 2°C above preindustrial levels. However, progress on decarbonization has stalled, with three significant factors driving the need for novel approaches:

Amidst the rise of renewables and electrification in areas like mobility and heating, the effective decarbonization of energy-intensive industries remains a challenge. Clean hydrogen offers a promising solution, especially for sectors like iron and steel production. However, its full potential depends on the presence of sufficient clean hydrogen supply and the necessary infrastructure, which is unlikely to be in place before the 2030s. Additionally, some industries (e.g., cement) cannot fully adopt hydrogen due to unavoidable emissions from chemical reactions during production.

These challenges require the adoption of new methods alongside existing efforts. Foremost among these is CCUS (see sidebar “What is CCUS?”) as an interim solution in industries that aim to adopt hydrogen in the future but have to meet shorter-term decarbonization needs (e.g., iron and steel) or require a long-term solution in the absence of alternatives (e.g., cement). The United Nations (UN) Intergovernmental Panel on Climate Change (IPCC) highlighted CCUS’s significance, underlining its importance in a 2022 report and emphasizing its role as an essential part of the transition to net zero.

CCUS facilities are currently operational in 11 countries around the globe, including the US, Brazil, Norway, Saudi Arabia, China, and Australia. An additional 14 nations are developing or constructing projects, including France, the UK, the Netherlands, Thailand, and Indonesia. However, due to its size, complexity, high investment requirements, long lead times, and supporting infrastructure (e.g., pipelines and storage facilities), CCUS is not yet widely available for current use.

Seventeen European countries have either implemented or announced plans for CCUS facilities. Of the EU’s 27 member states, 20 mention CCUS in their national energy and climate plans. In some countries currently without CCUS plans, the situation is changing. Germany, in particular, is seeing a renewed interest in the technology. However, ambitions to ramp up CCUS as part of national decarbonization strategy vary significantly with the UK, the Netherlands, and Norway, which collectively represent approximately 75% of currently planned carbon-capture capacity in Europe by 2030.

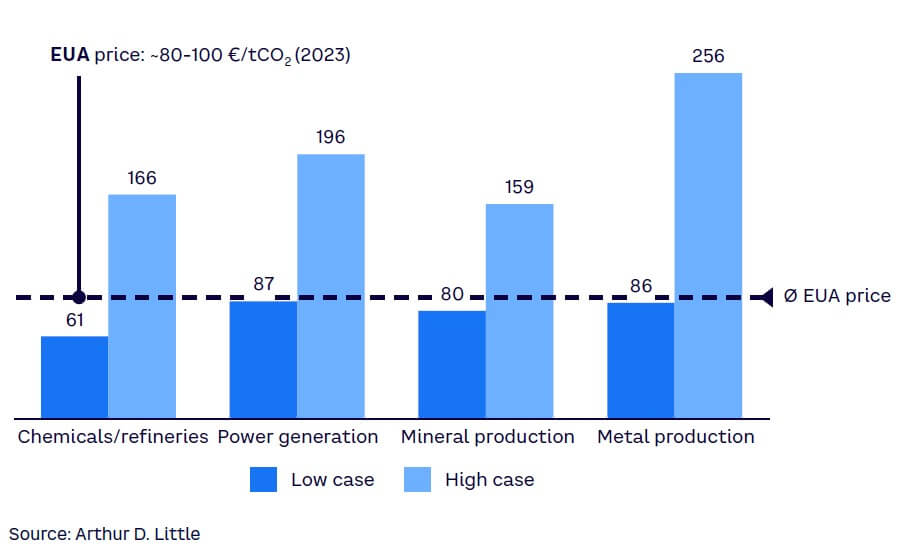

In Europe, CCUS adoption is driven by economic and regulatory costs for emitters. Based on European Energy Exchange (EEX) data, the European Union Allowance (EUA) price for emissions is expected to further increase beyond 100€/tCO2 by the middle of the 2020s, while the levelized cost of CCS is expected to further decline for most industries, as shown in Figure 1. This prediction is based on the realization of potential routes from Central Europe to offshore storage facilities in the North Sea. However, costs are still likely to outweigh potential EUA savings in certain applications for some sectors like metal production, and creating necessary CCUS facilities requires significant long-term investment.

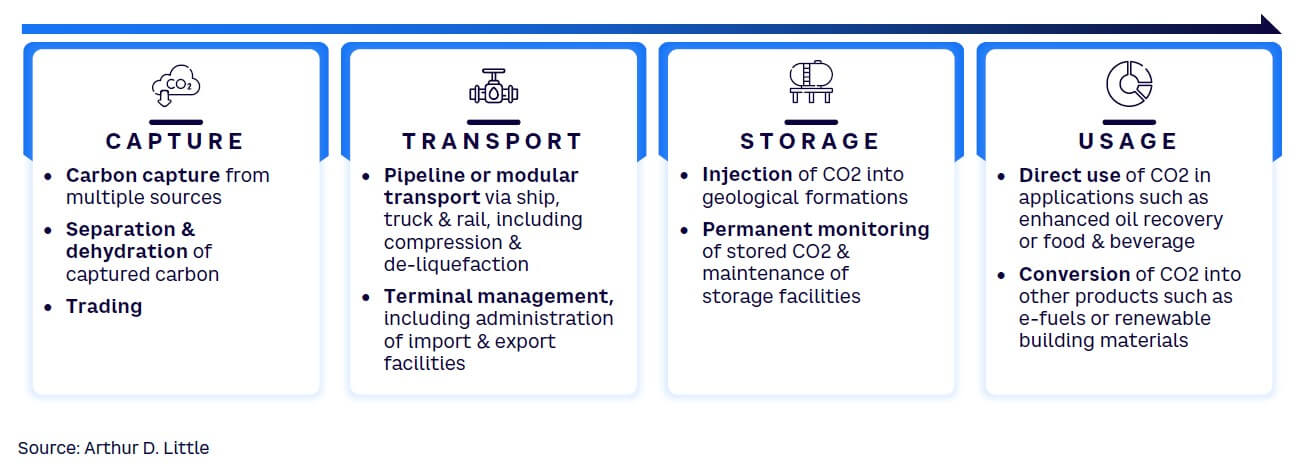

Players exploring opportunities within the CCUS ecosystem should understand the four steps in the value chain from source to sink (see Figure 2).

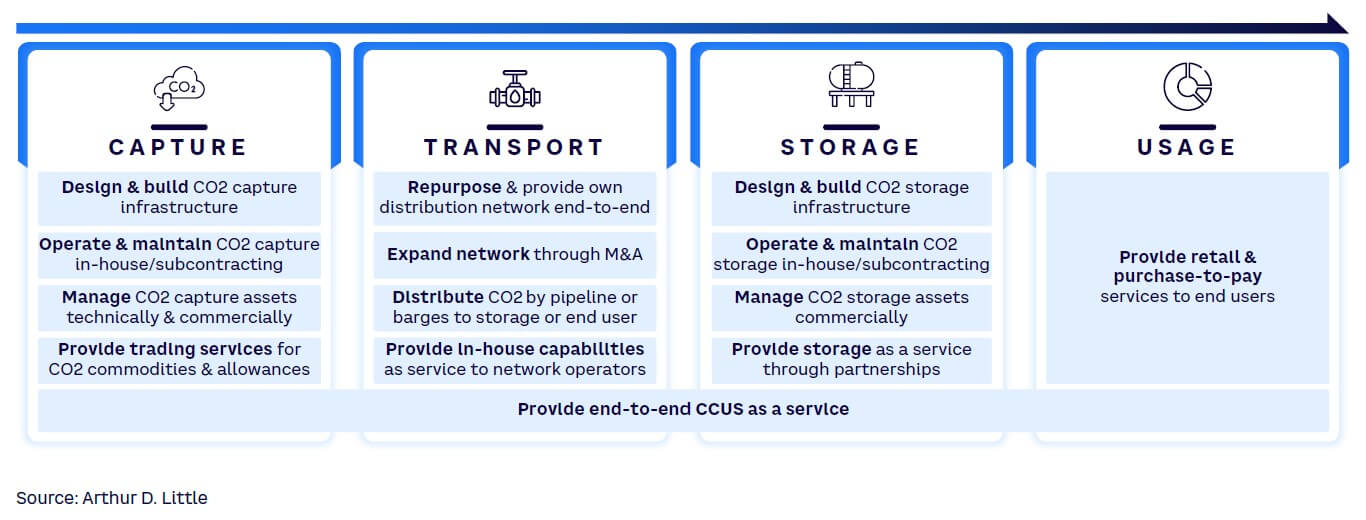

Altogether, the global market for CCUS was worth an estimated €2-€3 EUR billion in 2022, with a growth rate increase of 5% per annum during the previous five years, according to ADL analysis. As shown in Figure 3, the opportunities are:

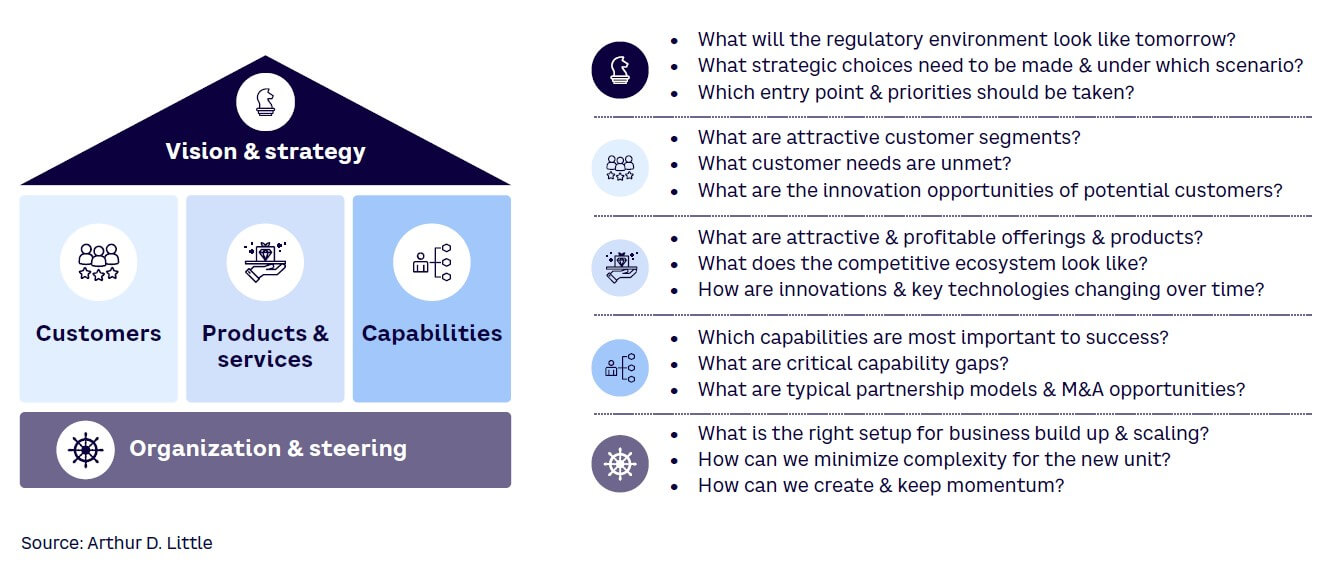

The rapid evolution of the CCUS market means that players need to move quickly to embrace opportunities, form partnerships, create new business models, and adopt innovation and suitable technologies. Success requires a focus on five building blocks, starting by setting a clear vision and strategy and then understanding customer needs, products, and services and developing relevant capabilities. To underpin these building blocks and create an effective strategy and operational plans, companies need to ask and answer key questions (see Figure 4).

However, the CCUS market is in its infancy, with many areas, including regulations, still being developed. For example, existing public subsidy incentives are largely not comparable to those in place to support renewables. There is also a need to address current public concerns around CCUS and promote greater acceptance of its benefits. This is especially the case in countries like Germany, where these worries have led to an effective ban on storing CO2 (see sidebar “The future of CCUS in Germany”).

Given the pace of change and the growing need for CCUS to meet decarbonization targets, waiting for regulations, infrastructure, and public opinion to align is not an option. It is vital for players to act now to harvest the potentials of the growing CCUS market and address the key questions of the building blocks outlined above: