Given that shipping is a critical component of a vast amount of global supply chains, it plays a significant role in the worldwide effort to achieve net zero emissions. This Viewpoint considers the maritime industry’s current response to climate change and what more it must do to reshape itself, in both the short and long term, through the adoption of increasingly sustainable practices.

Maritime transport is the lifeblood of global trade, but it is also responsible for generating 3% of the world’s greenhouse gases (GHGs) — that’s 1,708 million metric tons of emissions; based on Arthur D. Little (ADL) analysis, we expect this figure to rise to 44% by 2050 if measures aren’t put in place to control the increase.

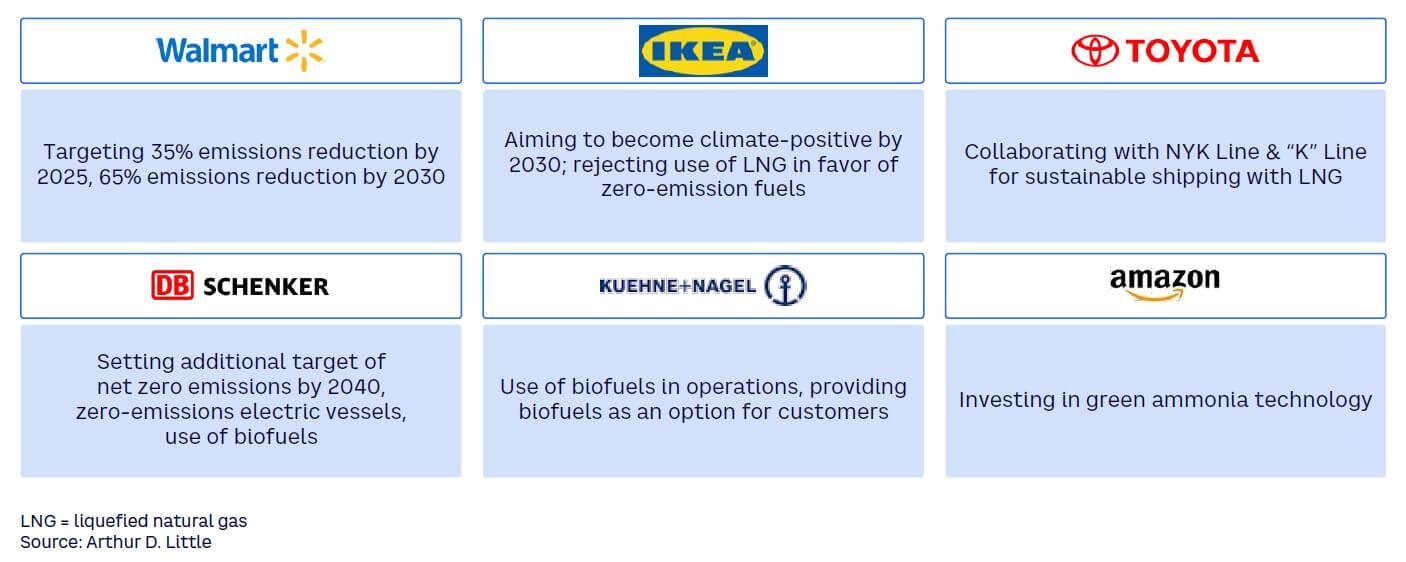

Consequently, green topics have become a top priority for the maritime sector as it faces growing pressure to decarbonize. Key users of shipping services like Ikea, Toyota, DB Schenker, Amazon, and Walmart have all publicly committed to reducing Scope 3 emissions along their supply lines with the aim of becoming net zero emitters over the next 10 to 20 years (see Figure 1).

In response to this changing environment, stakeholders across the value chain are using emission-trading systems, internal carbon pricing (ICP), and a range of carbon-reduction solutions to help monitor and manage the environmental impact of their operations.

Some shipping carriers have begun offering carbon-reduction services to their customers. For example, the Mediterranean Shipping Company (MSC), a prominent global container shipping company, has a Carbon Neutral Programme that calculates customers’ CO2 emissions and seeks to minimize or offset production.

Other carriers focus on helping customers track their supply chain emissions. One example is through the use of platforms like Maersk’s Emissions Dashboard, a subscription-based digital service, that gives customers real-time data and analytics on the environmental performance of their shipments. It can even run what-if scenarios to evaluate the environmental effect of various shipping strategies, such as adjusting a vessel’s speed or route.

These measures are voluntary, and although they can help companies meet carbon-reduction targets, they don’t carry the game-changing weight of legislation and regulation from national or supranational organizations.

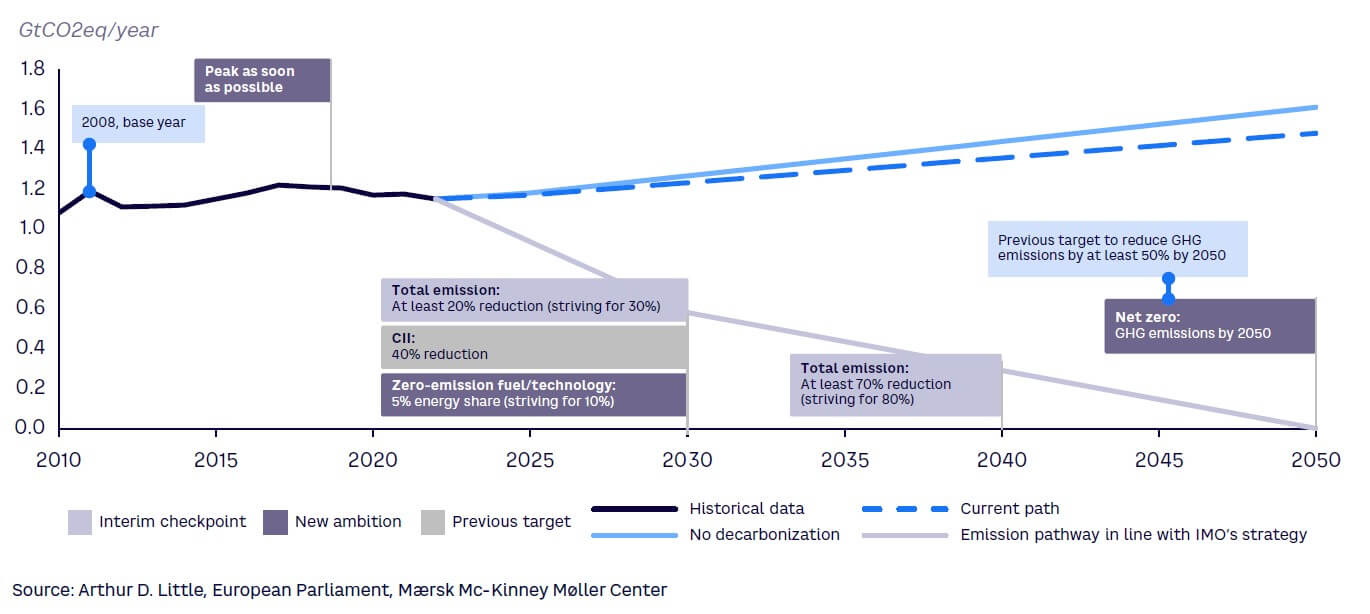

Signaling its commitment to environmental sustainability, the International Maritime Organization (IMO) is setting ambitious GHG-reduction targets, pushing for the maritime industry to reach net zero by 2050, having previously aimed for a 50% reduction of GHG emissions by that date (see Figure 2).

IMO will also indirectly seek to penalize ships that exceed designated GHG emission levels through its Carbon Intensity Indicator (CII), a measure of how efficiently a ship transports goods or passengers. In November 2022, it became mandatory for ships to calculate their CII based on the quantity of CO2 emitted per ton-mile of cargo transported. The expectation is that a poor CII will make it increasingly difficult to find favorable terms with financial institutions and port authorities. Beyond this, IMO has introduced a plan for at least 5% of energy used by international shipping to come from alternative fuels or energy sources and is striving to reach 10% by 2030.

For its part, the EU is imposing more direct financial penalties on shipping carriers that breach emissions targets through its Emissions Trading System, which focuses primarily on CO2 emissions and covers aviation and energy production, and FuelEU Maritime, which targets emissions from the maritime sector and includes not only CO2 emissions but other GHGs.

With the tightening of GHG-intensity targets, as set by FuelEU Maritime, noncompliant maritime operators face significant penalties. For instance, these penalties likely will increase the cost of conventional fuels for noncompliant shipping liners by 100% to 200% post–2030 for intra-Europe voyages.

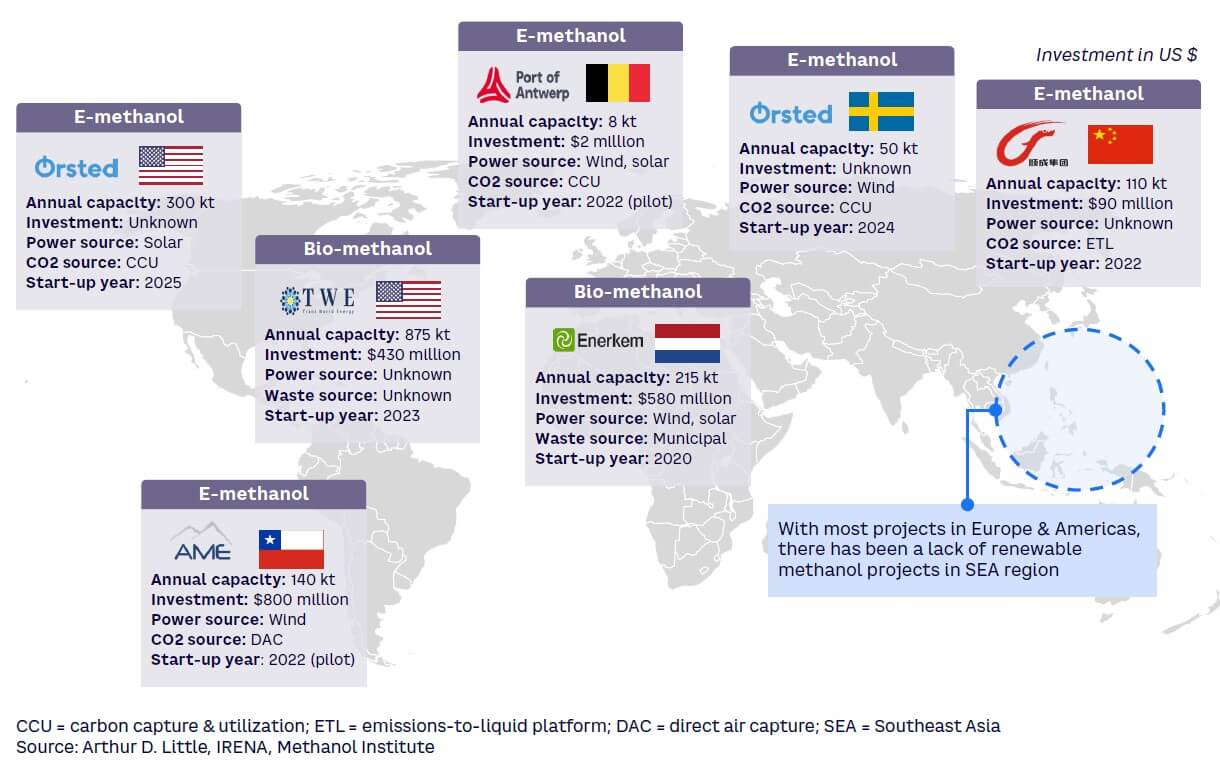

A more effective and sustainable way for the maritime sector to cut its GHG emissions is producing less of them in the first place. One major step involves switching from heavy fuel oil (HFO) to cleaner alternatives. Here, the maritime sector is at something of a transitional phase. A number of alternative fuel projects have been announced, but they will take time to come online, and this, combined with a lack of raw materials, means there is insufficient supply to meet the growing demand (see Figure 3).

Increasing use of blue methanol, ammonia, and hydrogen is an obvious first step, since these offer some decarbonization benefits, cutting emissions between 20% and 60%. They are relatively inexpensive to produce, and existing infrastructure can use them. However, they are not a sustainable long-term solution because they are fossil-based.

A better option is via usage of green fuels (e.g., biodiesel, bio-methane, and bio-methanol), which cut emissions by 60%-80%. Although these also use existing infrastructure, there are issues regarding their environmental impact and ability to scale at speed to meet demand given uncertainties over feedstock availability.

E-fuels such as e-methane, e-methanol, green ammonia, and hydrogen hold the most promise. They provide the greatest decarbonization benefits (up to 95%) and are consequently the regulators’ fuel of choice. However, they are more costly to produce than other green fuels, making them less commercially attractive. For example, based on ADL analysis, green methanol prices are expected to fall from today’s US $1,700 per ton to $900-$1,200 by 2027, leaving them well above shippers’ expectations, which are around $650-$750. For these fuels to become more widely adopted, shipping companies should be encouraged to use more of them, and producers must be incentivized to make more of them.

For shipping liners to adopt these fuels, a highly active maritime hub is crucial — the port must have scale, connectivity, and operational capability. It must also have a favorable business environment to facilitate maritime activities. On the production side, establishing global standards for carbon accounting, offering OPEX subsidies, and using mechanisms like contracts for difference would help remove the market uncertainty that surrounds green fuels and accelerate the move away from HFO.

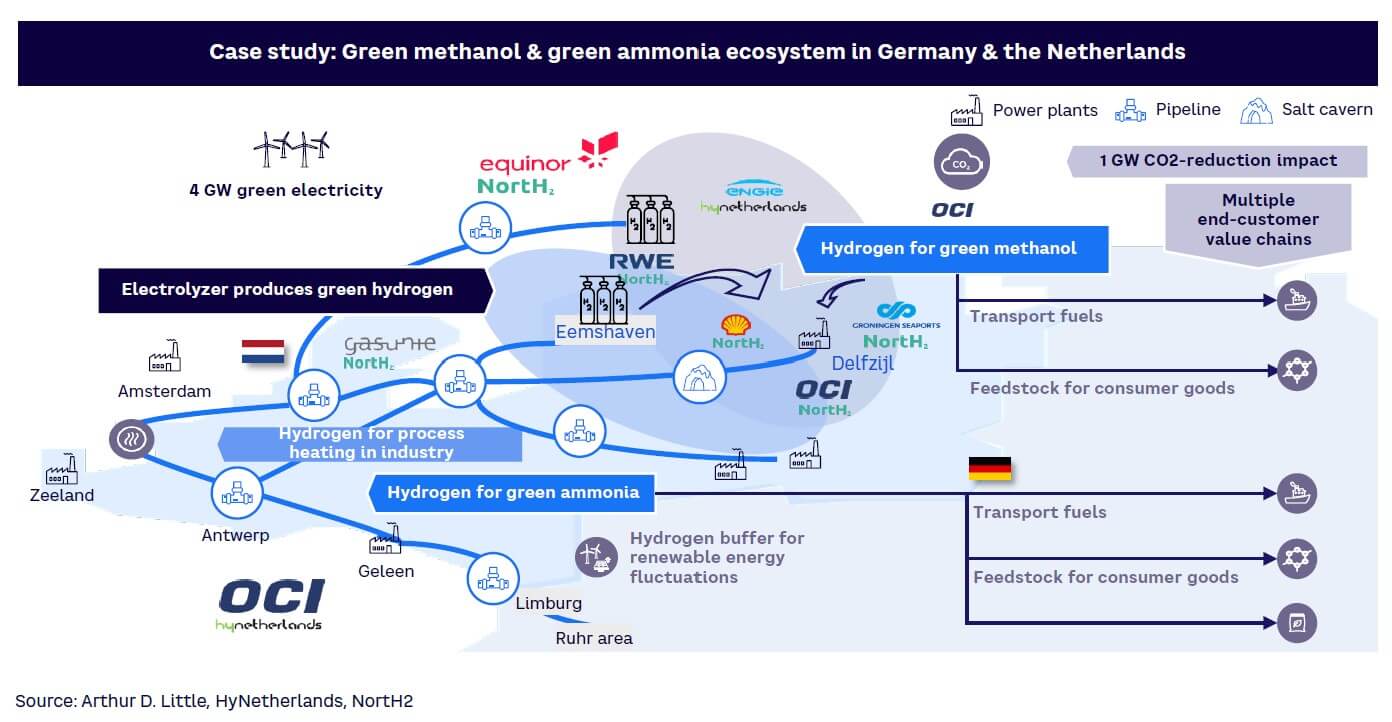

Although the feasibility of green fuel development projects has yet to be demonstrated, we can see how regulatory support will help facilitate it by looking at collaborative projects such as HyNetherlands and H2Global Foundation, a cross-country collaboration between the Netherlands and Germany aimed at stimulating the production of e-methanol and green ammonia. As supplies of hydrogen-based fuels from this project come online in 2024, we expect a price drop that will stimulate the hydrogen economy in these countries and beyond (see Figure 4).

Improving the operational efficiency of existing assets will go a long way in enabling the maritime industry to decarbonize. In the short and medium term (before zero-emission vessels become the norm), slow steaming and switching to larger vessels are options (although they are not always possible, given the need to meet customer needs and for port infrastructure that can handle the presence of larger ships). The real opportunities lie in the adoption of technical innovations.

For example, onboard carbon capture and storage (CCS) systems, which trap more than 60% of a ship’s CO2 emissions and can be installed without changing any existing equipment, are being tested on tankers and bulk carriers. We are also on the cusp of the ability to build autonomous cargo ships that can be sailed, cleaned, inspected, maintained, and protected from pirates by robots.

Wind-assist propulsion systems that make ships less reliant on their main engines can greatly diminish fuel consumption.

A kite-sail system, for instance, can bring down fuel consumption by a remarkable 20%-40% annually. Solar panels and fuel cells powered by green hydrogen or ammonia are emerging as promising options for decarbonizing propulsion systems, and battery-electric systems are finding a place in ferries and offshore support vessels. Improved hull designs and friction-reducing surfaces that cut drag can lead to fuel savings of up to 8%. Innovative materials such as graphene-doped anti-corrosion coatings and self-repairing finishes can improve vessel performance and longevity while reducing emissions by ensuring the consumption of fewer resources during maintenance (see Figure 5).

These types of improvements are not confined to offshore use. Port authorities across the globe are using technology to move to more sustainable and eco-friendly practices. Shore power and cold-ironing facilities, for instance, minimize vessel emissions while berthed by letting them connect to clean, grid-based electricity rather than running their traditional auxiliary engines.

To get a sense of where port technology is heading, we need only look at Singapore, which aims to become the world’s largest automated terminal by 2040 and ensure that at least half of all Singapore-flagged vessels are “green” by 2050. The Port of Singapore already generates renewable energy for lighting and to power environmentally friendly equipment, and its smart port manage