H.I.G. is a leading global private equity and alternative assets investment firm with over €31 billion of equity capital under management.* Based in Miami, and with offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco, and Atlanta in the U.S., as well as international affiliate offices in London, Hamburg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro and São Paulo, H.I.G. specializes in providing both debt and equity capital to small and mid-sized companies, utilizing a flexible and operationally focused / value-added approach:

1. H.I.G.’s equity funds invest in management buyouts, recapitalizations and corporate carve-outs of both profitable as well as underperforming manufacturing and service businesses.

2. H.I.G.’s debt funds invest in senior, unitranche and junior debt financing to companies across the size spectrum, both on a primary (direct origination) basis, as well as in the secondary markets. H.I.G. is also a leading CLO manager, through its WhiteHorse family of vehicles, and manages a publicly traded BDC, WhiteHorse Finance.

3. H.I.G.’s real estate funds invest in value-added properties, which can benefit from improved asset management practices.

Since its founding in 1993, H.I.G. has invested in and managed more than 300 companies worldwide. The firm's current portfolio includes more than 100 companies with combined sales in excess of €27 billion. For more information, please refer to the H.I.G. website at www.higcapital.com.

Team: 400 professionals worldwide and 13 in Spain.

|

Jaime Bergel |

Managing Director Spain |

|

|

Borja de Parias |

Principal LBO |

|

|

Jose María de Leon |

Principal LBO |

|

|

Ignacio Blasco Lafita |

Managing Director Whitehorse |

|

|

Gonzalo Sánchez-Arjona |

Senior Investment Manager LBO |

|

|

Gonzalo Boada |

Investment Manager LBO |

|

|

Lucía Trillo |

Business Development Associate |

|

|

Victor Kim |

Associate LBO |

|

|

Estebán Caja Samboal |

Principal Real Estate |

|

|

German Lopez-Madrid |

Senior Associate Real Estate |

|

|

Felipe Serra |

Associate Real Estate |

|

|

Emilio Recoder |

Principal Bayside |

|

|

Henrik Telle |

Principal Whitehorse |

Key data:

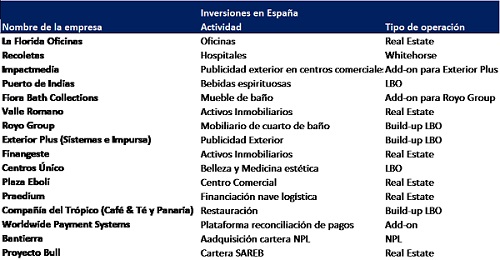

18 total investments

Global fund size: €26.000 m

European funds' size: €4.900 m

Investments in 2019: 2

Divestments in 2019: 0

Maximum investment: €100 m (bigger through Advantage BuyOut Fund)

Investment criteria:

Favorite sector (s): All

Predilection phase (s): Capital Expansion, Buy Outs and special situations

Geographical area (s) of predilection: From the Madrid office we focus on Spain and Portugal