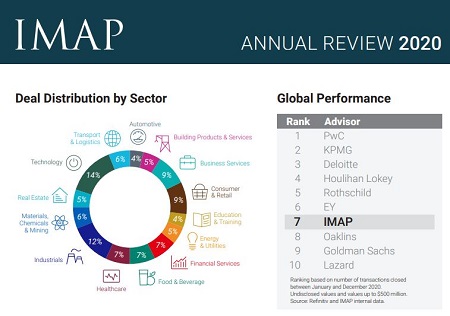

IMAP closed 193 M&A transactions valued at over $7.0 billion in 2020, down from the 7 year high of 235 deals closed in 2019. Transaction volume was down about 50% in Q2 2020, in both annual and quarterly terms, due to the global shock to market confidence and the restrictions on travel and in-person meetings, essential components of deal -making and due diligence process.

However, transaction activity bounced back to trend levels in the second half of the year as paused deals were reactivated, well-positioned buyers and sellers ventured back to the market and deal makers adapted to the new environment. Momentum is carrying over into the first half of 2021 , and the outlook remains cautiously positive, given that many ot the factors sustaining deal activity in recent years remain, including access to easy financing and a record amount of dry powder held by investors.

cloud technology axon

Sherpa Capital, firma de capital privado especializada en inversiones ...

Capital-Riesgo.es

Subscribe to our newsletter and stay up to date with the latest news and deals!

2013 © Capital-Riesgo.es - Site Developments SL. All Rights Reserved. Terms of Service | Privacy Policy

Articles

Directory