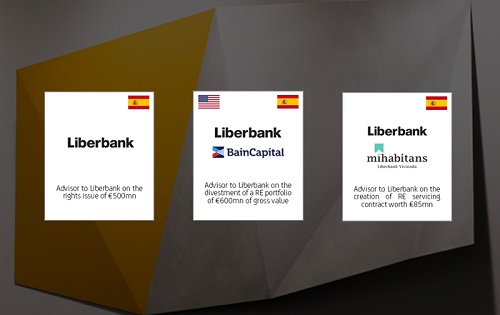

Alantra advised Spanish bank Liberbank in the design and execution of three different transactions with the aim of massively restructuring its Non-Performing Asset (NPAs) exposure.

The three transactions have been executed, almost in parallel, between July and November encompassing:

In addition to the advisory to BMN in the merger process with Bankia announced in July of this year, this transaction further demonstrates Alantra’s capabilities, and global approach, to structure and execute very complex transactions for banks.

cloud technology axon

Sherpa Capital, firma de capital privado especializada en inversiones ...

Capital-Riesgo.es

Subscribe to our newsletter and stay up to date with the latest news and deals!

2013 © Capital-Riesgo.es - Site Developments SL. All Rights Reserved. Terms of Service | Privacy Policy

Articles

Directory