My company Mammoth Hunters has gone over three successful financing rounds, all three of them done with crowdfunding. While writing this article our third crowdfunding campaign has reached the investment goal in just 16 days and is on its track to overfunding.

Many people come to me for advice on how to run their campaigns. In this article I share all this knowledge. I build upon an article I wrote about how I successfully closed my previous crowdfunding campaign in just 36 hours. This articles elaborates a bit more about the topic and touches upon some mistakes I have done and how to avoid them. I hope that after reading the article you’ll agree with me that a good strategy and execution are key to success in crowdfunding.

So let’s begin!

This is a question that entrepreneurs should ask themselves before they engage in a round. It’s a hard reality check that comes once you begin to run low on resources.

·Have you reached the milestones you promised in the previous round?

·Are you getting enough traction?

·Do you have a clear path to growth and profitability?

If any of these questions are answered with a NO, maybe it’s time to do a reality check and rethink the viability of the project.

Keep in mind that you are investing your time, money and health in the project and you are asking others to give you their money, so better use these scarce resources for something meaningful.

When you do a seed funding round, you want the money to test out the project. If you are doing a second round you should have already proven that your project is worth the money and effort. If it isn’t don’t ask for more.

In our seed round we promised we’d use the money to enter US market and to improve metrics. 8 months later we have grown from 50.000 users to almost 200.000, US represents 70% of our sales and we have improved our Signup to Paid Conversion ratio from 3% to 5%. And we almost doubled Lifetime value per customer. So it’s easy to pitch our business to investors.

1.Read the instructions.

2.Crowdfunding is sales.

3.Plan, plan, plan … EXECUTE!

4.Start with the round closed.

5.Keep up the momentum.

You can find more details above points in my previous post about crowdfunding. I highly recommend to follow them. It will give you a double value: 1) You’ll close the round and 2) You’ll enjoy the process.

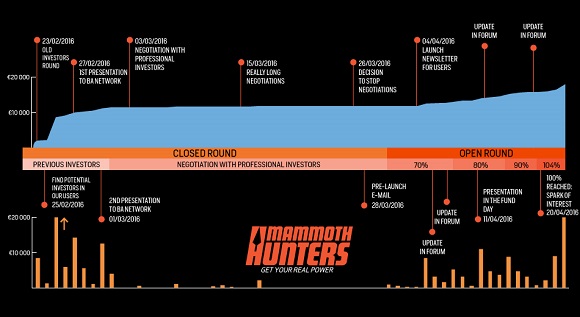

When planning this round (about 1 month and a half before launching) I told my community manager to prepare a post announcing we reached our goal for day 15th. This announcement finally was released on day 16th. The reason for such accuracy was a good planning and execution. All this work led to pure enjoyment as the round progressed. By contrast another company that was fundraising at the same time in the same platform had only raised 2% of the round in the same amount of time. Imagine the level of stress they had!

When I decided to fundraise again, the first thing I did was to ask my previous investors if they wanted to reinvest. I got an incredible response. Out of my 168 investors 50 said they would invest again covering 1/3 of the round. Then I asked them if they could give the money in advance so we could continue running our company smoothly while fundraising. 40 investors did it giving us 6 extra months of runway.

How did I accomplish that?

Obviously by performing very well. As I mentioned in the first point, a company that is doing well is easy to sell and the people who knew better were my investors. But most important because I had built a relationship of trust with them over the previous months.

One of the core values at Mammoth Hunters is transparency. We believe that being honest pays off. In the case of my investors, this transparency means that every month I write a 3 – 4 pages’ report explaining everything we did in the previous months and how metrics evolved. I report all actions, the ones that are successful and the ones that are not and then I explain why I think they have not worked and what we are doing to improve.

Writing this reports takes 1 or 2 days and I’ve been told that I’m wasting my time. However, I have come to think about it as the wisest decision I have made. Taking the time to digest what we are doing helps me decide how to move forward. It’s also a good way to make all the team accountable for their actions and to align our efforts. In the case of my relationship with investors, it has been key to build trust with them. So when the time has come to ask for their help, I’m receiving it.

In our previous crowdfunding round, we focused our efforts in convincing Mammoth Hunters users to invest. The strategy worked like a charm and we closed the round in 36 hours. The same strategy wouldn’t work this time. Our user growth had been mainly in US since the last crowdfunding round. Since we were doing our crowdfunding in Spain and in Spanish, it was almost impossible to attract our US users to invest. In addition, US laws make it hard for small investors to participate.

This is why I decided to go for Business Angels (BA) first. This was a mistake.

Relationships with professional investors take time. From the fist presentation in a forum to get the money in the bank it can take months and several meetings. On the other hand, a crowdfunding campaign has closed dates. It starts on a fixed day and it has a due day.

In my original plan I wanted to close deals with private investors before the round so that I could go to the crowd with most of the investment already secured. Once I started negotiations, I realized that it’s nearly impossible to have the deals closed by the dates I had planned for the Crowdfunding round. So I delayed the crowdfunding round twice. When I was about to delay it for a third time, I realized that things where not working as planned. That’s when I decided to switch plans.

I decided to set a more modest goal for the Crowdfunding campaign that would adjust to the potential I had gauged. The idea was to close fast and show that I was able to raise money on my own before going to professional investors.

As a result of this change of strategy, I have already been contacted by several Business Angel networks to present in their forums. As I write this article I don’t have data on how much interest I have sparked. But I assume that going there with 260.000€ (and running to reach 300.000€) will make things easy to raise an extra 100.000€ or 200.000€ more (I’ll update you).

This is an extension of the “Keep the momentum” rule I mentioned before. In the chronogram of the round, you’ll see that there is a continuous flow of messages that I sent to Mammoth Hunters’ users (via newsletter and social media) and to Crowd Cube leads (via the forum). I have also been writing personal emails to potential investors. Before starting I prepared what I wanted to say in each message. I also took the opportunity of a networking event that Crowd Cube organized to announce a big partnership (I was the only company not doing a regular pitch!). I wrote some articles in the forum explaining some of our core metrics and finally I am right now writing this article.

All these actions have the clear purpose of showing to potential investors that we do a great job and that we are worth their money. This is especially important in crowdfunding as our investors are not high net worth individuals with a lot of disposable income. They are rather regular folks wanting to diversify their portfolio with small investments.

This is my final advice. I learned the hard way how to do crowdfunding by suffering a lot in my first round and spending a lot of time in my second. This third one has been much easier and more successful thanks to my experience.

I am really happy to help others go through the same process avoiding common mistakes. If you want to start a campaign, please read as much as you can and if you need more advice do not hesitate to send me a message. I am sure you can also find successful crowdfunders in your communities. Go and ask them the best practices they followed. Most people are happy to share their help for free and even if they charge you, it might be money well invested.

And with this I finish, hopefully I have helped you a bit in preparing your next round. I also hope you have liked the way we undertake projects at Mammoth Hunters. If this is the case maybe you are interested in investing in this round. You can do so with a few clicks in our campaign page.

Oriol Roda Noguera

PhD & MBA

CEO Mammoth Hunters

Please consult for futher details: